The Sandbox (SAND) continued its bullish development, hitting a brand new yearly excessive of $0.86 throughout Monday’s early Asian session. Nonetheless, it has since pulled again by 14%, buying and selling at $0.76 at press time.

Regardless of the latest surge, on-chain and technical indicators counsel that the much-anticipated $1 value goal stays unlikely for now. Right here’s why.

The Sandbox’s Lengthy-Time period Holders E-book Revenue

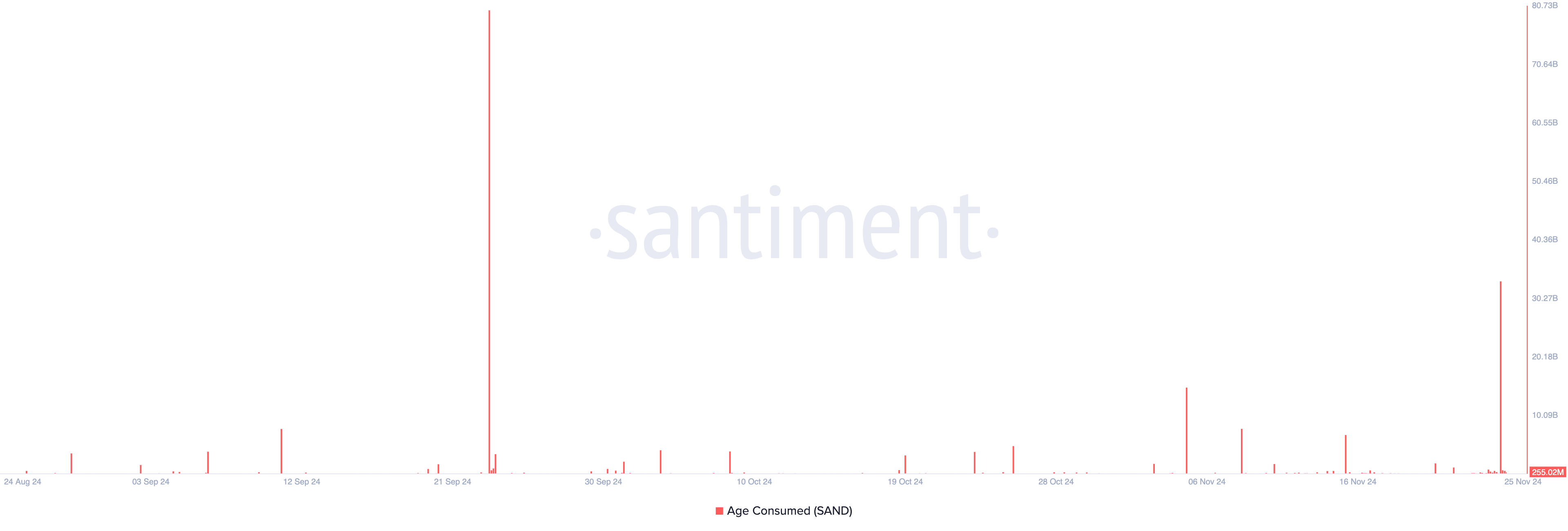

SAND’s value hike over the previous week has prompted its long-term holders to maneuver their beforehand dormant tokens round. That is mirrored within the surge within the token’s age-consumed metric, which measures the motion of long-held cash. In accordance with Santiment, this skyrocketed to a two-month excessive of 33.19 billion on Sunday.

This metric’s rally is notable as a result of long-term holders usually are not within the behavior of shifting their cash round. Subsequently, once they do, particularly during times of value uptick, it hints at a shift in market developments. Vital spikes in age-consumed throughout a rally like this counsel that long-term holders are offloading, presumably resulting in elevated promoting stress.

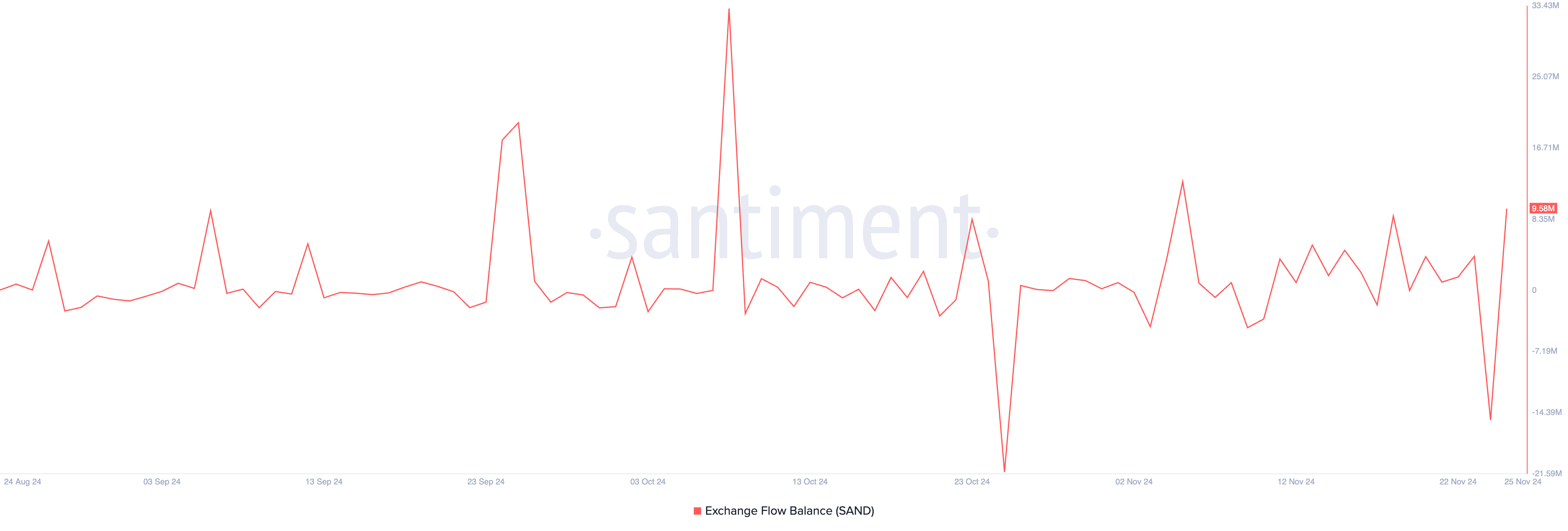

Notably, the rise in SAND’s Trade Move Steadiness over the previous 24 hours confirms the promoting exercise. In accordance with Santiment, this metric, which measures the web distinction between the quantity of an asset despatched to exchanges and the quantity of an asset withdrawn from exchanges over a selected interval, has climbed by 162%.

This displays a rise within the quantity of SAND tokens being deposited to exchanges. It alerts that holders are getting ready to promote, presumably resulting in downward value stress.

On the every day chart, SAND’s Relative Energy Index (RSI) stands at 87.18, indicating overbought situations. The RSI measures whether or not an asset is oversold or overbought, starting from 0 to 100. Values above 70 sign that the asset is overbought and will face a decline, whereas values beneath 30 counsel it’s oversold and would possibly rebound.

With an RSI of 87.18, SAND is signaling overbought situations, placing it susceptible to a near-term pullback. If a decline happens, its value might drop to $0.72. Elevated promoting stress at this degree might push SAND additional right down to $0.61, distancing it much more from the sought-after $1 goal.

Alternatively, the SAND token value might reclaim its year-to-date excessive of $0.86 if the promoting stress wanes. This may invalidate the bearish thesis above.

Disclaimer

Consistent with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.