JPMorgan Chase & Co., the biggest financial institution in the USA, has revealed its substantial Bitcoin exchange-traded fund (ETF) holdings.

The disclosure contains a wide range of investments in numerous Bitcoin ETFs, showcasing the financial institution’s important involvement within the cryptocurrency market.

JPMorgan Chase Reveals Bitcoin ETF Holdings

The report highlights 25,021 shares of Bitcoin Depot Inc., valued at $47,415. JPMorgan additionally holds 6,475 shares of the Bitwise Bitcoin ETF, price $250,647, alongside a smaller stake of 55 shares valued at $2,129. The Constancy Sensible Origin Bitcoin ETF accounts for 16 shares, valued at $1,043. Moreover, the financial institution holds 40 shares of the Grayscale Bitcoin Belief, valued at simply $2.

Within the iShares Bitcoin Belief, JPMorgan owns 11,000 shares price $445,170, and an extra 797 shares valued at $32,255. The ProShares Bitcoin Technique ETF additionally kinds a part of the financial institution’s portfolio, with 14 shares valued at $452, and 831 shares price $26,841.

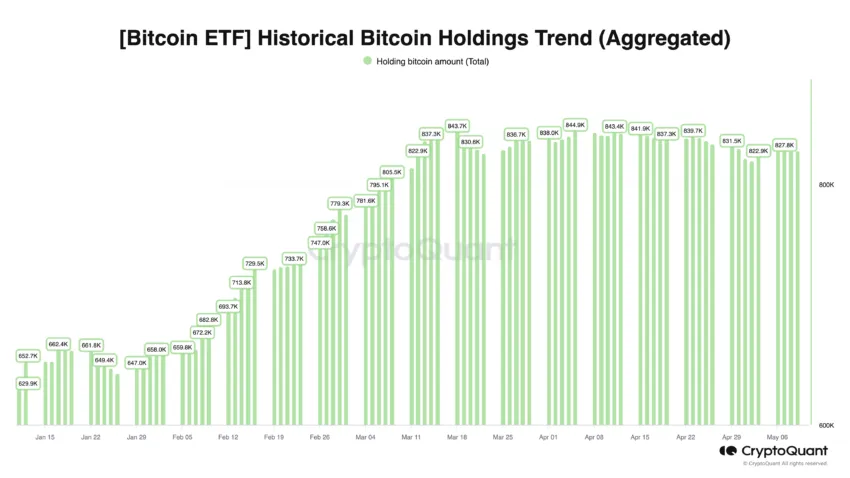

The disclosure highlights JPMorgan’s strategic method to cryptocurrency funding, leveraging a diversified portfolio throughout numerous Bitcoin ETFs. This transfer aligns with the rising institutional curiosity in digital belongings regardless of current market volatility.

Learn extra: How To Commerce a Bitcoin ETF: A Step-by-Step Method

Regardless of the current information, Bitcoin’s worth skilled a 4.75% decline. Regardless of this, the Open Curiosity solely noticed a 3.91% lower of $647 million, with liquidations totaling $167 million over 24 hours. This means that the market has not but totally deleveraged, reflecting ongoing uncertainty.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.