LDO, the native token of main Ethereum staking supplier Lido DAO, has witnessed an 8% value hike over the previous 24 hours. Buying and selling quantity has additionally jumped by 58% throughout the evaluate interval, reflecting the surge in exercise across the altcoin.

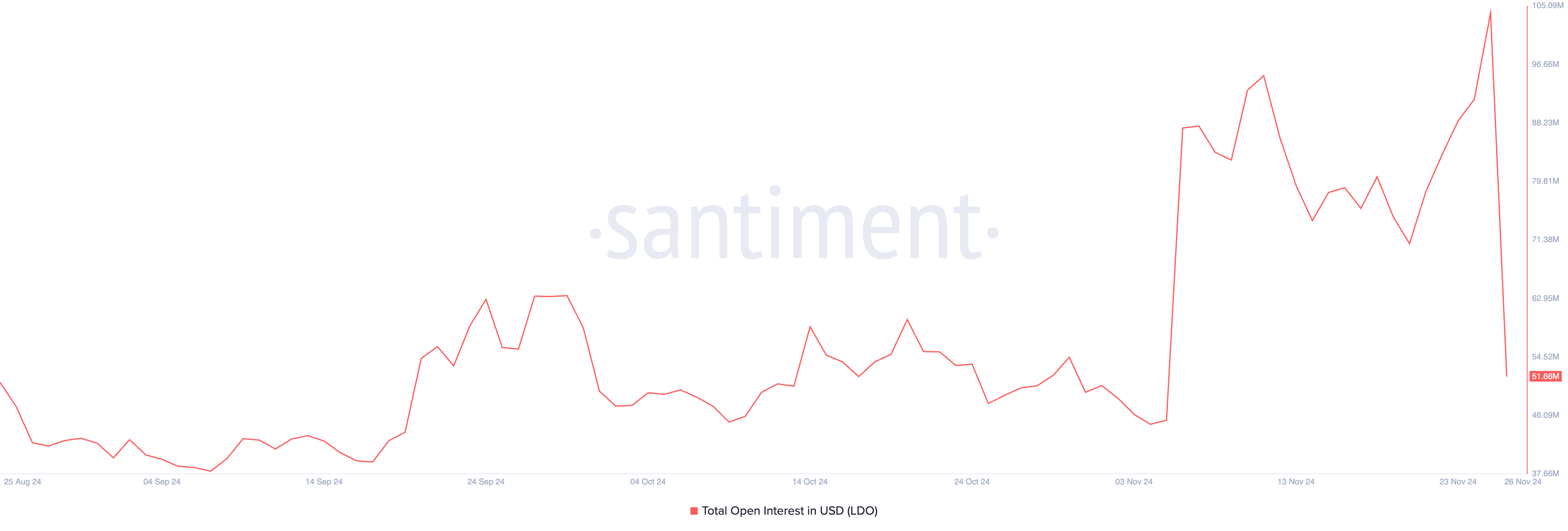

Nevertheless, the previous 24 hours have been marked by a major dip in LDO’s open curiosity. This implies that some futures merchants could also be taking earnings after current positive factors.

Lido’s Buying and selling Quantity Reaches All-Time Excessive

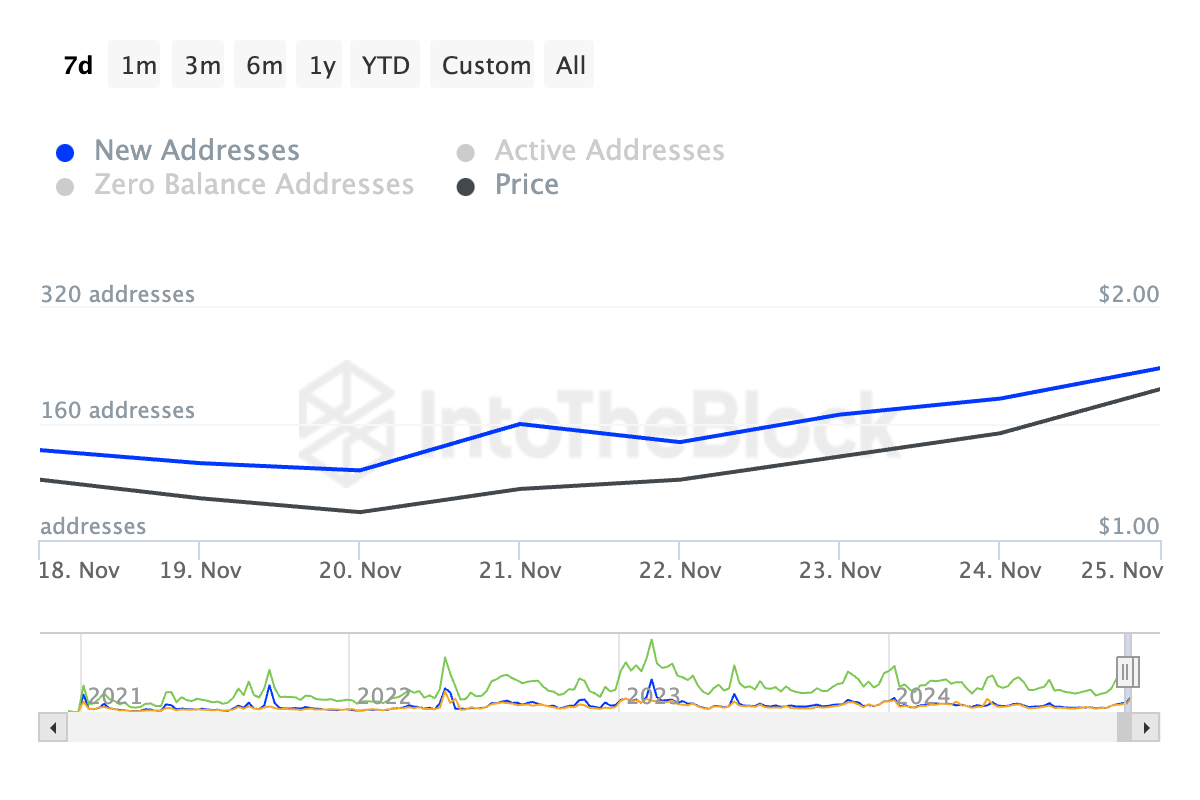

LDO’s rally over the previous 24 hours has been fueled by a notable surge in demand throughout this era. Based on IntoTheBlock, 891 distinctive addresses accomplished at the very least one LDO transaction on Monday, marking its highest single-day depend since February 2023.

When a surge in every day energetic addresses accompanies a value hike, it alerts elevated community exercise and person engagement. This implies that the value rally is pushed by real demand for the asset reasonably than speculative buying and selling.

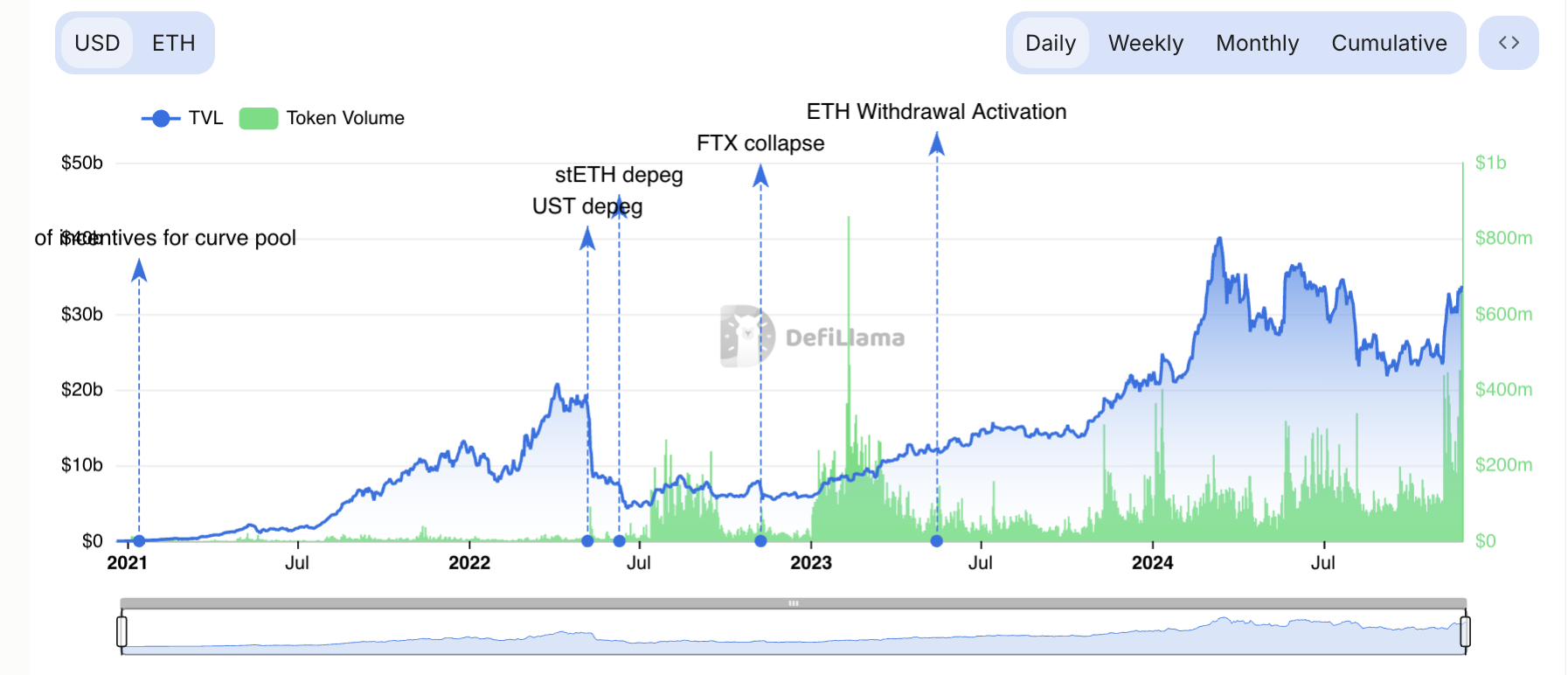

Notably, at present, LDO’s buying and selling quantity throughout cryptocurrency exchanges has totaled $670 million. Per DefiLlama’s knowledge, this represents its all-time excessive because the ETH-staking protocol was launched.

Nevertheless, LDO’s 8% uptick has been accompanied by a major dip in its open curiosity. Per Santiment’s knowledge, this stands at $52 million at press time, declining by 50% over the previous 24 hours. This displays a hike in profit-taking among the many token’s futures merchants following the value soar.

Open curiosity tracks the full variety of excellent futures or choices market contracts that haven’t but been settled or closed. When it decreases throughout a value rally, merchants who had beforehand purchased the asset have determined to exit their positions and lock in earnings. When these positions are closed, the full variety of excellent contracts decreases, even when the value continues to climb.

LDO Worth Prediction: Token Might Climb To Multi-Month Excessive

On the every day chart, LDO’s 8% rally has pushed it above a descending channel, which it had traded inside since January. This sample is shaped when an asset’s value trades inside two downward-sloping trendlines, indicating a downtrend.

When the value breaks above the higher trendline of the descending channel, it alerts a possible shift in market sentiment, indicating a reversal of the downtrend. This breakout suggests elevated bullish momentum, as patrons could also be gaining management and pushing the value larger.

If LDO’s shopping for stress strengthens, its value might climb to $2.09, a degree final reached in August. Then again, if promoting stress positive factors momentum, LDO’s value will shed current positive factors and fall to $1.08 if the $1.56 assist degree fails to carry.

Disclaimer

In keeping with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.