A US federal appeals courtroom struck down sanctions imposed by the Treasury Division on Twister Money. This well-liked crypto-mixing service allows customers to anonymize their cryptocurrency transactions by sensible contracts.

The ruling, delivered by the Fifth Circuit Court docket of Appeals, marks a big victory for decentralized know-how proponents and privateness advocates. On the similar time, it reignites debates about regulate using blockchain instruments in reference to felony actions.

Treasury Division’s Sanctions In opposition to Twister Money Overturned

The Treasury’s Workplace of International Belongings Management (OFAC) had sanctioned Twister Money in 2022. In keeping with the company, the platform was a key software for illicit actors, together with North Korea’s Lazarus Group, to launder stolen funds.

Nonetheless, the courtroom dominated that OFAC overstepped its authority. It emphasised that the immutable sensible contracts underpinning Twister Money can’t be thought of property below the Worldwide Emergency Financial Powers Act (IEEPA).

The appellate courtroom’s determination hinged on the nature of Twister Money’s sensible contracts. These are autonomous strains of code designed to perform with out human intervention.

These contracts, deployed on the Ethereum blockchain, are unalterable and accessible to anybody. The courtroom discovered that such contracts don’t meet the authorized definition of “property” as a result of they can’t be owned, managed, or restricted.

“The immutable smart contracts at issue are not property because they are not capable of being owned,” the courtroom wrote.

The courtroom additional famous that whereas sanctions would possibly block sure people from utilizing Twister Money, the know-how’s decentralized nature ensures that nobody, together with North Korean hackers, may be totally prevented from accessing it. Paul Grewal, Coinbase’s Chief Authorized Officer, hailed the ruling.

“This is a historic win for crypto and all who cares about defending liberty…These smart contracts must now be removed from the sanctions list and US persons will once again be allowed to use this privacy-protecting protocol. Put another way, the government’s overreach will not stand… No one wants criminals to use crypto protocols, but blocking open source technology entirely because a small portion of users are bad actors is not what Congress authorized. These sanctions stretched Treasury’s authority beyond recognition, and the Fifth Circuit agreed.” Grewal wrote on X (previously Twitter),

Grewal additionally emphasised the significance of distinguishing between instruments and their misuse. Of notice, Coinbase, a number one cryptocurrency trade, was among the many entities that sued the federal government over the sanctions.

Broader Implications for Crypto Regulation

The ruling exposes the challenges of making use of present authorized frameworks to decentralized applied sciences. Crypto-mixing providers like Twister Money occupy a authorized grey space, prompting requires scrutiny by US lawmakers.

They’re neither conventional monetary (TradFi) establishments nor entities able to being managed by a government. Critics of the ruling argue that it may embolden unhealthy actors to take advantage of blockchain know-how additional.

“If you think Tornado Cash has been used by good people for worthwhile purposes then make your case…If privacy protects good people it’s good, if it protects bad people it’s bad. The vast majority of people that Tornado Cash has protected are doing bad,” one person on X quipped.

Some lawmakers have beforehand pressed the Treasury to undertake stricter measures in opposition to crypto mixers. In 2022, members of Congress highlighted issues about their position in facilitating cash laundering and funding terrorism. A bipartisan push aimed to make sure that instruments like Twister Money, usually related to felony networks, face regulatory scrutiny.

Nonetheless, privateness advocates argue that focusing on the instruments somewhat than the actors undermines the rules of decentralization and privateness. Invoice Hughes, a lawyer at ConsenSys, applauded the courtroom’s nuanced understanding of the problem however highlighted a key subject. He cautioned that regulatory dangers stay.

“This does NOTmean that the rest of Tornado Cash is out of bounds for Treasury/OFAC too. The issue was about smart contracts with no admin key,” Hughes wrote.

Because of this the courtroom’s determination doesn’t protect Twister Money from different authorized challenges, notably these regarding its founders. As BeInCrypto reported, they face accusations of facilitating cash laundering. Furthermore, the broader debate over regulate decentralized applied sciences stays unresolved.

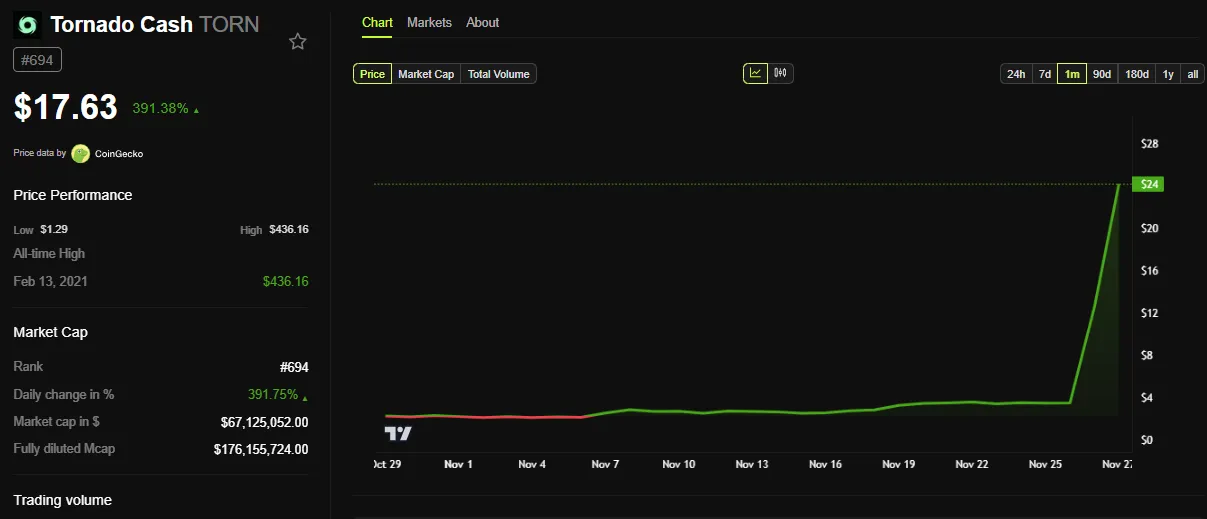

Following the ruling, nonetheless, Twister Money’s native token, TORN, is up virtually 400% to commerce for $17.63 as of this writing.

This surge displays investor optimism concerning the protocol’s potential resurgence and its implications for decentralized finance (DeFi) tasks.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.