Bittensor (TAO)’s worth has risen 10% within the final 24 hours, solidifying its place as the most important synthetic intelligence coin by market cap at $4.2 billion. The Ichimoku Cloud, RSI, and EMA strains all level to a robust uptrend.

The RSI at 65 suggests there’s nonetheless room for additional positive factors earlier than coming into the overbought territory, whereas the EMA setup helps a possible climb to $625.

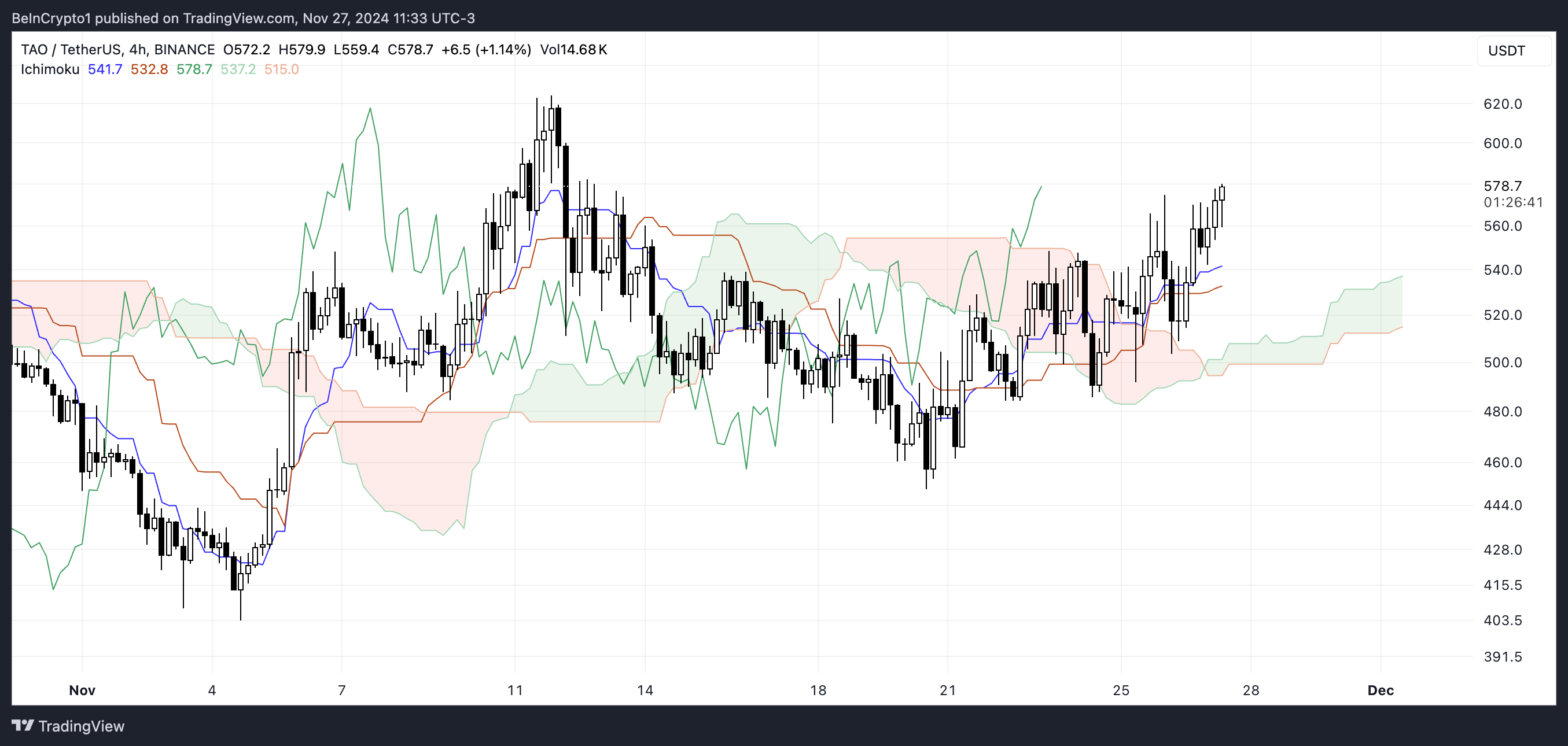

TAO Ichimoku Cloud Exhibits The Uptrend Is Sturdy

The Ichimoku Cloud chart for TAO reveals a bullish development. The worth is buying and selling above the cloud (Senkou Span A and B), indicating upward momentum. The Tenkan-Sen (blue line) and Kijun-Sen (orange line) are additionally positioned under the worth, supporting the bullish sentiment.

The cloud itself has shifted to inexperienced, reinforcing mid-term assist, whereas the upward slope suggests continued energy within the uptrend.

Nonetheless, the worth is approaching key resistance ranges, and the narrowing hole between the Tenkan-Sen and Kijun-Sen signifies a attainable slowdown in momentum. If TAO fails to take care of its place above the Tenkan-Sen, a pullback towards the cloud may happen.

Conversely, a breakout above present ranges would affirm the continuation of the bullish development, with the inexperienced cloud performing as a cushion for any potential retracement.

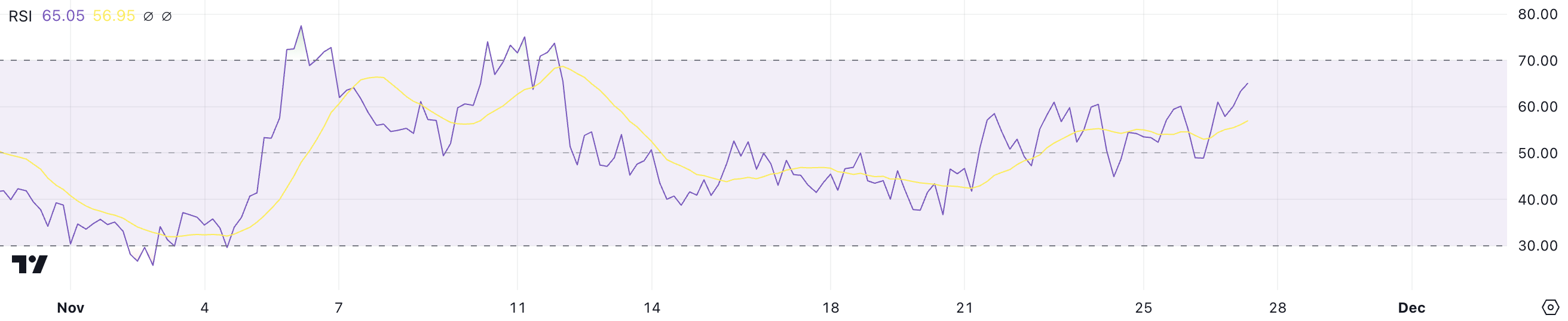

Bittensor Isn’t Overbought But

Bittensor RSI has risen to 65 from 49 within the final two days, reflecting sturdy bullish momentum as the worth surges. The RSI, or Relative Power Index, measures the velocity and magnitude of worth actions on a scale of 0 to 100.

Values above 70 point out overbought situations, suggesting a attainable pullback, whereas values under 30 sign oversold ranges, typically resulting in a restoration. The present RSI reveals that whereas Bittensor is nearing overbought territory, it nonetheless has room for additional positive factors earlier than a correction.

Traditionally, TAO’s worth has continued to climb till its RSI reaches 72 or 75, which suggests the present uptrend could have extra room to run. If the RSI continues to rise, TAO may lengthen its rally within the quick time period.

TAO Value Prediction: Again to $600 Quickly?

TAO’s EMA strains are presently very bullish, with short-term strains positioned above long-term ones and the worth buying and selling above all of them. This setup signifies sturdy upward momentum, supported by constant shopping for strain.

If this bullish sentiment continues, TAO worth may climb one other 8% to check resistance round $625, solidifying its uptrend and TAO’s dominance as the largest synthetic intelligence coin out there.

Nonetheless, if the present uptrend loses energy, TAO worth could face a retest of key assist ranges at $510 and $487. Ought to these helps fail, the worth may decline additional to $449, marking a big 22% correction.

Disclaimer

In keeping with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.