The US Securities and Change Fee (SEC), in its opposition to Coinbase’s movement for an interlocutory enchantment, criticized Decide Analisa Torres’s choice in its case in opposition to Ripple.

In a submitting dated Could 10, the SEC contended that the courtroom mustn’t entertain Coinbase’s bid to reassess the appliance of securities regulation to digital property.

SEC Says Coinbase Does Not Like Howey Take a look at

Coinbase, in its plea for an Interlocutory evaluation, contends that the SEC’s utility of the Howey take a look at to cryptocurrency property has muddled the definition of securities. The alternate closely leans on Decide Torres’s ruling within the Ripple case. On the time, the choose deemed the XRP token non-securities and its programmatic gross sales on exchanges not constituting funding contracts.

Nonetheless, the SEC rebuffs Coinbase’s movement, stating that no courtroom has adopted Decide Torres’s choice. The regulator asserts that Coinbase’s try to border an interlocutory enchantment round a “controlling question” is a bid to govern the interpretation of the difficulty.

Learn Extra: Coinbase Assessment 2024: The Greatest Crypto Change for Learners?

“Coinbase’s attempts to manipulate the question for an appeal to shoehorn it into a certifiable question under 28 U.S.C. § 1292(b) are self-defeating. Parties cannot manufacture a certifiable issue by jettisoning and then rescuing the questions at issue in the original order,” SEC wrote.

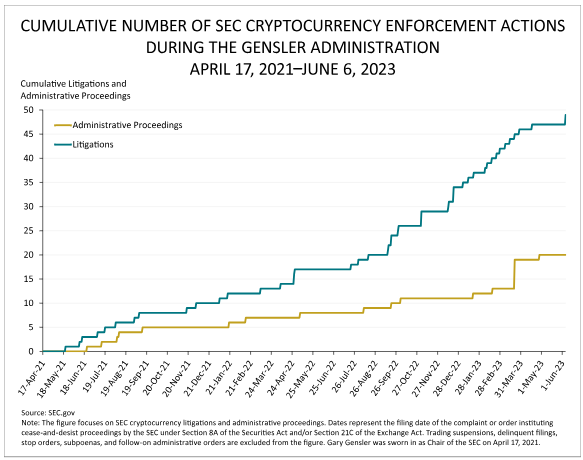

The SEC additional argues that an interlocutory evaluation is just not justified merely as a result of Coinbase proposes a brand new authorized normal. Moreover, the Gary Gensler-led company posits that Coinbase might merely dislike the longstanding reply the courts present. In response to the regulator, Coinbase might need structured its enterprise in ways in which might now pose challenges to complying with established securities laws.

“Despite the Order’s unassailable conclusions that Coinbase’s proposed reading of Howey has not been adopted by any

court and, critically, that there is no lack of fair notice as to the framework that applies to its conduct, Coinbase continues to insist, as grounds for interlocutory review, that ‘[t]he digital asset industry labors under an intolerable cloud of uncertainty’ or under a ‘cloud of legal uncertainty,’” the SEC acknowledged.

Coinbase’s Chief Authorized Officer, Paul Grewal, responded that the SEC’s movement contradicts itself. Grewal shared screenshots displaying differing arguments introduced by the SEC in an identical enchantment in opposition to Ripple Labs.

“Let’s at least have an honest conversation. Forget about a split across agencies, circuits and elsewhere. There’s not even a consensus about Howey and digital assets among the district judges in the same courthouse at Foley Square,” he added.

Learn extra: Who Is Brian Armstrong? A Deep Dive Into the Coinbase Founder

In the meantime, the ongoing authorized dispute between the regulatory company and the cryptocurrency alternate takes one other step ahead with this submitting. Beforehand, the company accused Coinbase of working as an unregistered alternate and raised considerations about its staking program doubtlessly violating securities legal guidelines.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.