XRP (Ripple) worth has surged to its highest ranges in six years, reaching new milestones amid rising optimism across the coin’s ecosystem. The coin has skyrocketed roughly 450% over the previous 30 days, making it one of many best-performing cryptocurrencies available in the market.

The exceptional worth motion comes as technical indicators recommend robust bullish momentum, although some metrics trace at potential consolidation forward.

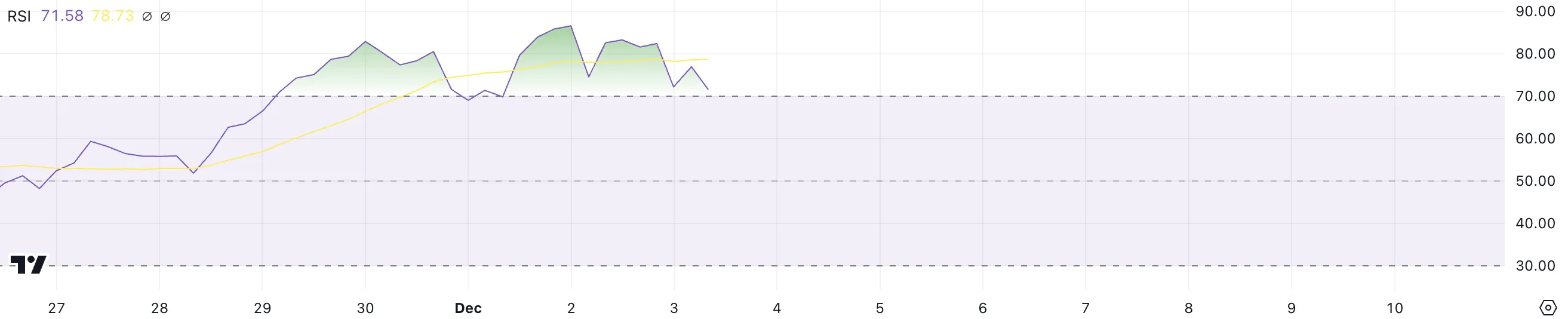

XRP RSI Is Nonetheless Above 70

The Relative Energy Index (RSI) for XRP has maintained an overbought place above 70 since late November, reaching peaks close to 90 earlier than lately declining to 71.5. This sustained interval in overbought territory aligns with Ripple important worth surge, demonstrating robust bullish momentum that has dominated the marketplace for a number of weeks.

The RSI serves as a momentum indicator, measuring the velocity and magnitude of worth actions on a scale of 0 to 100. Readings above 70 sometimes point out overbought circumstances, and beneath 30 recommend oversold circumstances.

Whereas XRP RSI stays in overbought territory at 71.5, its gradual decline from current highs close to 90 may sign that purchasing strain is beginning to ease. Nevertheless, this doesn’t essentially predict a direct reversal of the uptrend, as belongings can preserve overbought circumstances throughout robust bull runs.

The lowering RSI would possibly recommend a possible consolidation section or a extra sustainable tempo of development slightly than a definitive finish to the present uptrend.

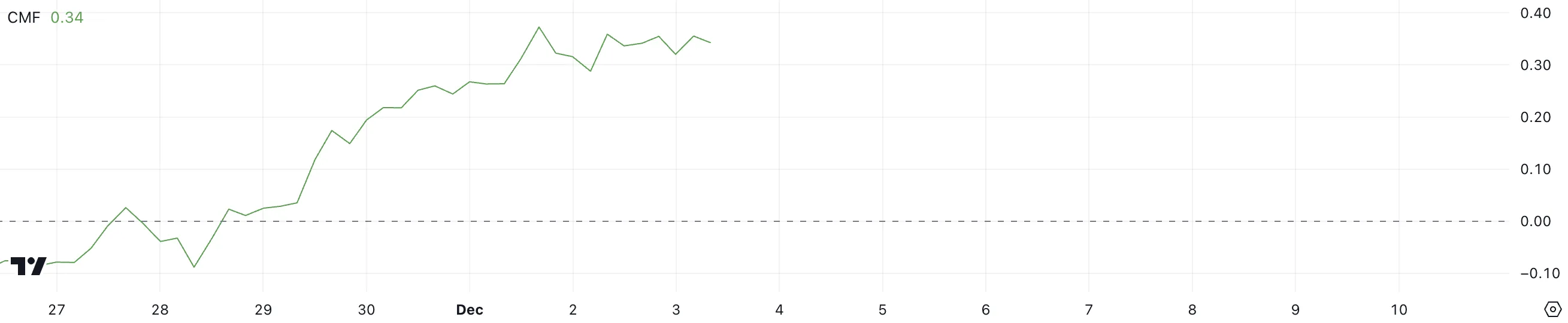

Ripple CMF Has Been Optimistic For 4 Days

The Chaikin Cash Circulation (CMF) for Ripple worth has maintained a robust constructive worth of 0.34, persevering with its upward momentum since November 29.

The CMF is a volume-weighted common of accumulation/distribution over a specified interval, sometimes 20 days, that helps measure shopping for and promoting strain. Values above zero point out internet shopping for strain, whereas damaging values recommend promoting strain.

XRP elevated CMF studying of 0.34 signifies substantial shopping for strain and institutional curiosity, supporting the present uptrend. This excessive constructive worth suggests that the majority buying and selling quantity happens at costs increased than the earlier interval, reinforcing bullish sentiment.

Whereas the CMF stays considerably constructive, it helps the continuation of the uptrend.

XRP Value Prediction: Can It Rise To $3 In December?

XRP EMA Traces show a robust bullish construction, with sooner EMAs positioned above slower ones and worth buying and selling comfortably above the shortest EMA. Because the bull run continues, XRP faces a big psychological and historic goal at $3.00.

Past that, the all-time excessive of $3.18 presents the subsequent main resistance, representing a possible 18.5% acquire from the present XRP worth.

Nevertheless, the uptrend carries draw back dangers that merchants ought to contemplate. Key assist ranges have shaped at $2.29 and $1.88, marking potential pullback targets if momentum wanes.

A correction to those ranges would symbolize a big retracement of as much as 32% for XRP worth, although such pullbacks are frequent even inside sustained bull tendencies.

Disclaimer

Consistent with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.