Solana worth staged a powerful restoration after dropping to a low of $204 on Dec. 11, with indicators pointing to a extra sustained rebound.

Solana (SOL) rose to $227, bringing its market cap to over $107 billion. This restoration mirrored that of different cryptocurrencies, together with Ripple (XRP) and Avalanche (AVAX). Listed here are the three explanation why the SOL worth might quickly leap to over $500.

Information exhibits that Solana is turning into more and more scarce because the variety of tokens on exchanges continues to say no. Nansen knowledge signifies that the quantity of SOL tokens on exchanges fell by 13% within the final seven days to 282.24 million.

This decline is probably going pushed by two elements. First, many buyers are transferring their cash to self-custody wallets. Second, a big variety of buyers are staking their SOL tokens. In line with StakingRewards, Solana’s staking ratio stands at 65%, larger than that of most cash like Ethereum (ETH), Polkadot (DOT), and Cosmos (ATOM).

Second, Solana might proceed rising due to its position within the crypto trade. Information exhibits that protocols on the Solana community dealt with $32.46 billion in buying and selling quantity over the previous seven days, surpassing Ethereum’s $25 billion.

Along with its DEX dominance, Solana is gaining traction in different areas of the crypto trade, together with gaming and decentralized public infrastructure. This development is translating into monetary features, with the community amassing over $672 million in charges this 12 months.

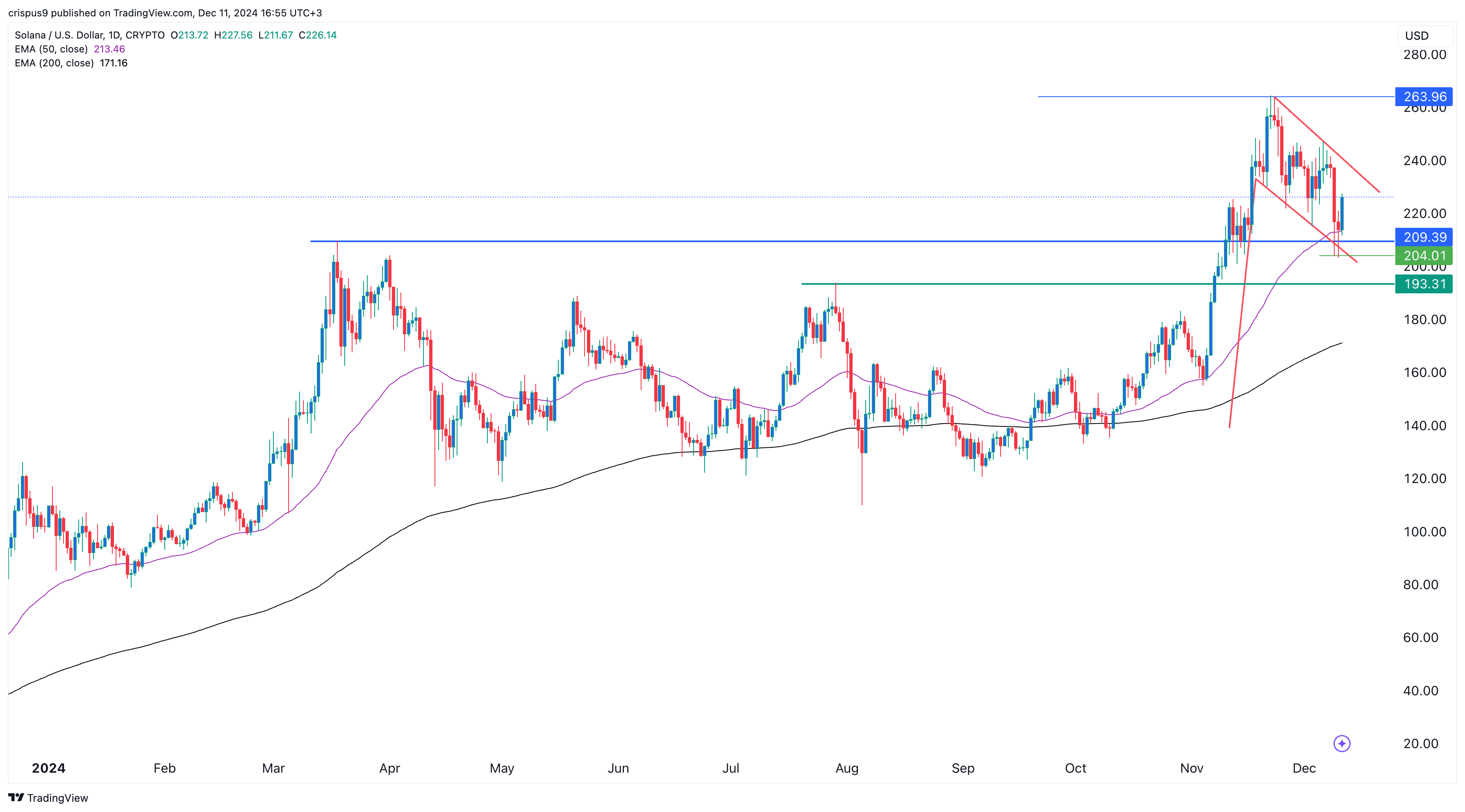

Solana worth technicals counsel extra features are doable

Third, technicals counsel that Solana worth has extra features to go. On the every day chart, the coin has shaped a bullish flag sample, which occurs when an asset kinds an extended vertical line and a flag-like sample. It is without doubt one of the most bullish patterns out there.

Solana has additionally shaped a break-and-retest sample by falling to $210 on Tuesday. This was an essential stage because it was the very best swing in March this 12 months. It’s common for an asset to retest a key resistance or assist stage after which proceed the uptrend.

On the weekly chart, SOL has additionally shaped a cup-and-handle sample with a depth of roughly 97%. By projecting 97% from the higher facet of the cup at $260, the value may doubtlessly rise to $511 in the long run.