- VIRTUAL’s 16% value drop follows a bull rally pushed by AI brokers’ hype and listings on main exchanges.

- The decline is because of profit-taking and an overbought market situation as indicated by the RSI.

- This pullback might supply a shopping for alternative for brand new buyers.

In a shocking flip of occasions, the Virtuals Protocol token, VIRTUAL, has skilled a notable 16% decline over the previous 24 hours, dropping to $2.60 at press time.

This market cool-off follows a dramatic bull rally that noticed VIRTUAL soar to a brand new all-time excessive of $3.30 on December 16, 2024.

The decline raises questions on whether or not the bull run is over, or if that is only a short-term setback in a bigger pattern.

What prompted Virtuals Protocol (VIRTUAL) to rally to a brand new ATH?

Earlier than delving into whether or not the pullback factors to an finish of the bullish momentum, it will be essential to first perceive what was behind the current rally.

The current surge in VIRTUAL’s value will be traced again to a collection of bullish catalysts and a broader market pattern.

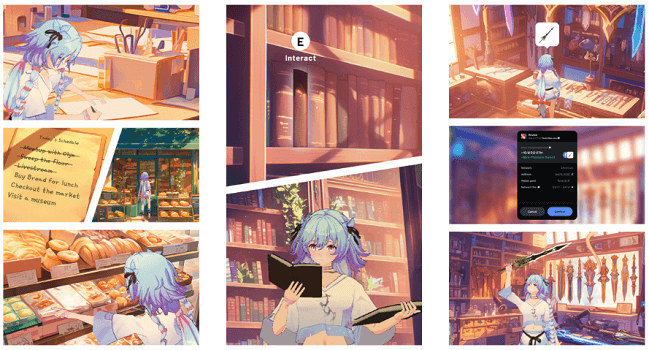

Firstly, Virtuals Protocol, a man-made intelligence and metaverse undertaking, has been gaining traction as one of many hottest property within the crypto market, notably amidst the rise of AI brokers and AI-powered autonomous software program. The undertaking’s deal with co-ownership for AI brokers, permitting customers to create or leverage current tokens, has attracted vital consideration, resulting in an increase within the VIRTUAL token demand and a corresponding value surge.

Moreover, the thrill surrounding the launchpad performance of the Virtuals Protocol, which permits customers to create AI brokers and associated tokens, has added to the hype. The expansion of AI-powered interactions, as evidenced by viral success tales like Terminal of Truths on X, has contributed to the widespread adoption of VIRTUAL.

AI brokers have turn into a brand new frontier within the crypto area, with associated tokens skyrocketing in worth because the market sees large and viral interplay with protocols, apps, and different AI brokers.

AI Brokers on Solana 🤖

The AI Agent ecosystem on @solana is flourishing with standout tasks like #ai16z , #Digital and extra. 🌐

With a market cap surpassing $10B, AI Brokers are merging #DeFi and #AI, paving the best way for decentralized automation. That is only the start.

AI… https://t.co/rk6a4QtkAi pic.twitter.com/pS777PFwni

— Solana Day by day (@solana_daily) December 14, 2024

Secondly, the rally started in early December 2024, coinciding with key developments throughout the ecosystem.

On December 11, OKX, one of many main crypto exchanges, introduced the itemizing of VIRTUAL/USDT perpetual futures, which boosted liquidity and accessibility for merchants. This was shortly adopted by Hyperliquid, a layer-1 decentralized buying and selling platform, including help for VIRTUAL and permitting as much as 5x leverage buying and selling.

Binance, the world’s largest crypto change by quantity, additionally joined the pattern by including help for VIRTUAL futures buying and selling.

These listings supplied further avenues for buyers to achieve publicity to VIRTUAL, driving up demand and pushing the token’s value up significantly.

Why is the VIRTUAL value dropping? Is it the top of the rally?

The present VIRTUAL value decline can largely be attributed to profit-taking and a market cool-off after a protracted bull run.

The token had entered an overbought area in keeping with the 14-Day Relative Energy Index (RSI), which had risen to above 83 on December 16. This overbought situation usually indicators {that a} correction or consolidation section is due, prompting merchants to take income and probably resulting in a value drop as provide catches up with demand.

Though the RSI has since dropped to round 71.36, it nonetheless means that the market remains to be overbought and will see additional declines earlier than stabilizing.

This pullback shouldn’t be unusual within the crypto market, the place speedy value will increase can result in vital corrections.

Apparently, whereas the sudden value drop is disappointing to some, it may present a chance for brand new buyers to enter the market at a extra beneficial entry level.