That’ s main query within the NYT a short time again (simply attending to this now that I’ve completed grading).

America’s modern economic system, Mr. Rieder argued in his observe to shoppers, is much less susceptible to the boom-and-bust cycles of previous — primarily as a result of its affluent customers are service-oriented, much less dependent than ever on factories or farms. Consumption spending makes up about 70 % of the economic system.

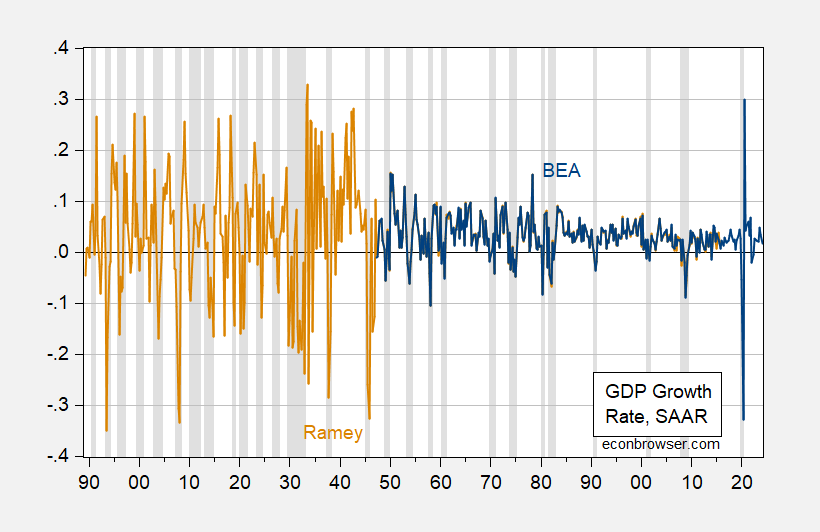

In a single sense, it’s indeniable that the enterprise cycle is much less pronounced, if one seems to the time sequence properties of actual GDP.

Determine 1: Quarter-on-Quarter annualized GDP progress charge from BEA (blue), from Ramey (tan), calculated in log variations. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, Ramey, NBER and writer’s calculations.

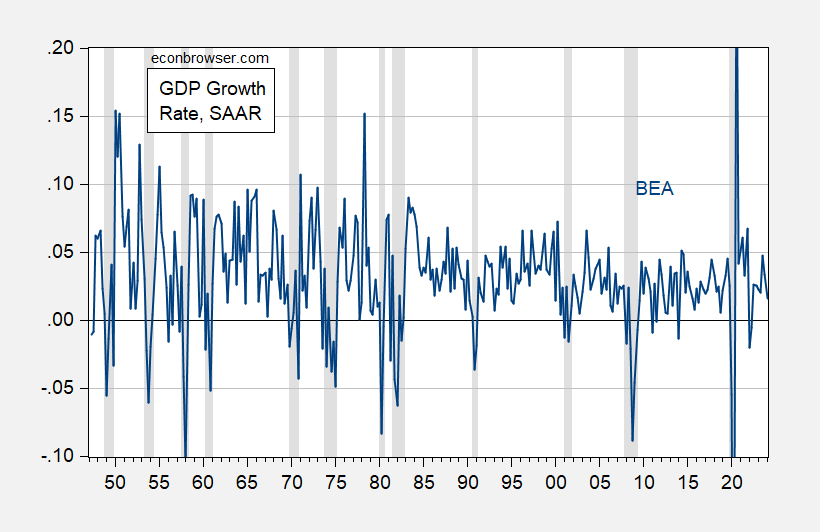

Even for the pattern compiled by BEA, one has the next image of typically declining volatility in GDP.

Determine 2: Quarter-on-Quarter annualized GDP progress charge from BEA (blue), calculated in log variations. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, NBER and writer’s calculations.

Except for the pandemic associated recession, GDP volatility has been a lot smaller. The size of expansions as decided by NBER has additionally elevated. This variation has been obvious for a very long time, and prompted Bernanke’s coining of the time period “the Great Moderation”.

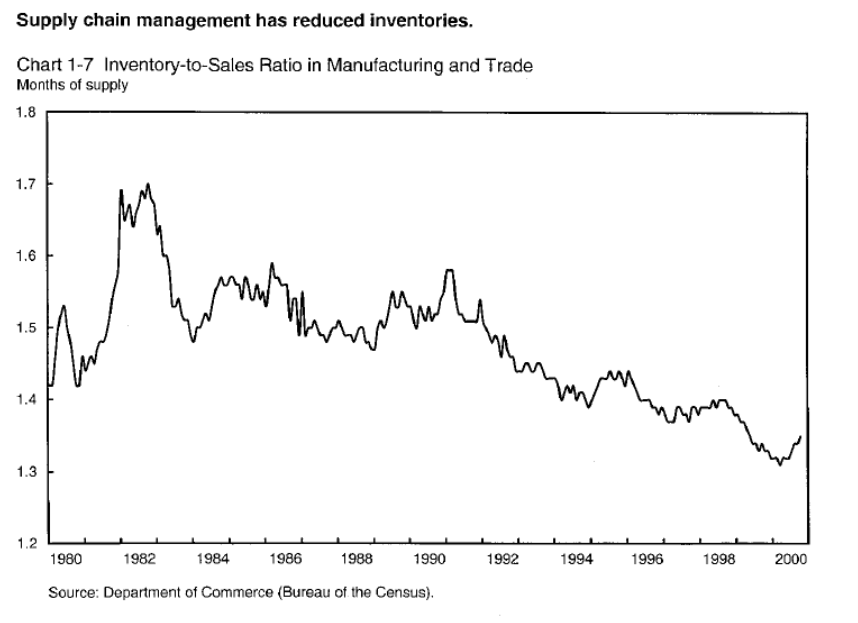

The dialogue jogs my memory of the discuss across the flip of this century about how new data applied sciences would permit for enhanced stock administration (Financial Report of the President, 2001):

The brand new data applied sciences have additionally modified the character of relationships between corporations and their suppliers. Procurement practices have modified radically, as corporations develop into linked to suppliers via Web-based business-to-business marketplaces. This functionality permits companies to streamline procurement actions, decrease transactions prices, enhance the administration of provider relationships, and even interact in collaborative product design. “Just-in-time” supply, facilitated by a extra environment friendly transportation community together with each floor and aviation infrastructure, has been instrumental in permitting corporations to cut back inventories and decrease prices whereas persevering with to offer important companies to producers and customers.

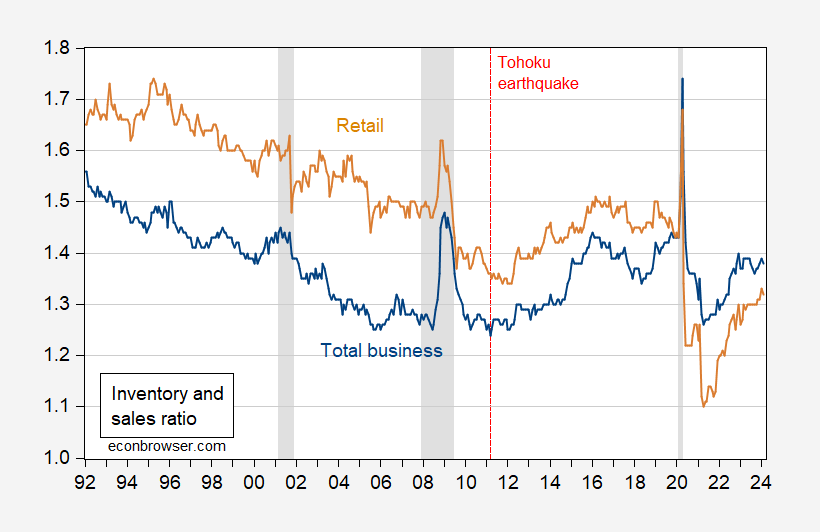

I don’t have entry to the identical sequence, however listed below are inventory-sales ratio for whole enterprise and for retail, with pattern extending to 2023Q4.

Determine 3: Stock-to-sales ratio for whole enterprise (blue), for retail (tan). NBER outlined peak-to-trough recession dates shaded grey. Supply: Census through FRED.

Stock ratios proceed to shrink after 2000, till 2008 when interrupted by the Nice Recession. They begin to rise once more after the Tohoku earthquake in Japan, which highlighted the hazards of remote provide chains.

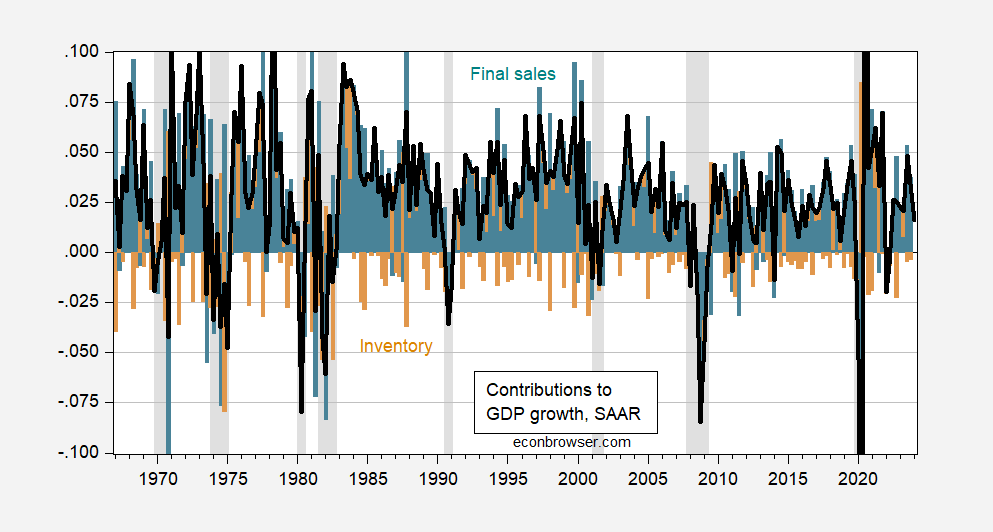

What does appear true is that the relative contribution of stock modifications to total GDP progress has declined over time.

Determine 4: GDP q/q annualized progress charge (black line), contribution of ultimate gross sales (teal bar), contribution of stock modifications (tan bar). NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA.

So, to some extent, the story that we inform in intro macro about disequilibrium within the Keynesian cross being eradicated by stock decumulation or accumulation through manufacturing modifications is much less related than previously. Whether or not that continues to be true relies on the extent of re-shoring, or friendshoring, as nations and corporations try to shock-proof provide chains.

As famous within the NYT article, nonetheless, different shocks — demand and provide — stay, together with monetary crises (2007-09), debt crises (2009-12) or pandemics (2020). For me, the enterprise cycle stays, at the same time as some propagation modes may need develop into much less related.