China’s overseas alternate regulator has launched new legal guidelines requiring banks to flag dangerous transactions, together with these involving cryptocurrencies.

The State Administration of Overseas Change (SAFE) issued a discover final week outlining that banks should monitor and report “risky foreign exchange trading behaviors.”.

China Forces Banks to Report Dangerous Crypto Trades

In line with the newest report, these rules will make it tougher for Chinese language buyers to commerce Bitcoin and different digital belongings. The banks should report on foreign exchange actions, together with underground banking, cross-border playing, and unlawful monetary transactions involving cryptocurrencies.

Additionally, the report specified that the foundations will likely be relevant to all Chinese language banks. The banks will now monitor trades primarily based on the identities of the people and establishments concerned, the supply of funds, and the frequency of trades.

This transfer displays China’s ongoing strict strategy to regulating business crypto actions. Cryptocurrencies are seen as a menace to the nation’s monetary stability.

Liu Zhengyao, a lawyer at ZhiHeng legislation agency in Shanghai, commented on the brand new rules in WeChat, in keeping with the South China Morning Put up.

“ The new rules will provide another legal basis for punishing cryptocurrency trading. It can be foreseen that mainland China’s regulatory attitude towards cryptocurrencies will continue to tighten in the future.” Liu stated.

Liu additionally famous that the follow of utilizing yuan to purchase cryptocurrencies after which exchanging them for overseas fiat currencies might now be thought-about a “cross-border financial activity involving cryptocurrencies,” particularly if the transaction quantity exceeds the authorized restrict.

China’s Anti-Crypto Stance

Since 2017, China has restricted cryptocurrency buying and selling and banned banks and cost programs from dealing with digital belongings. In Could 2021, the Individuals’s Financial institution of China (PBOC) declared all transactions involving Bitcoin and different cryptocurrencies unlawful.

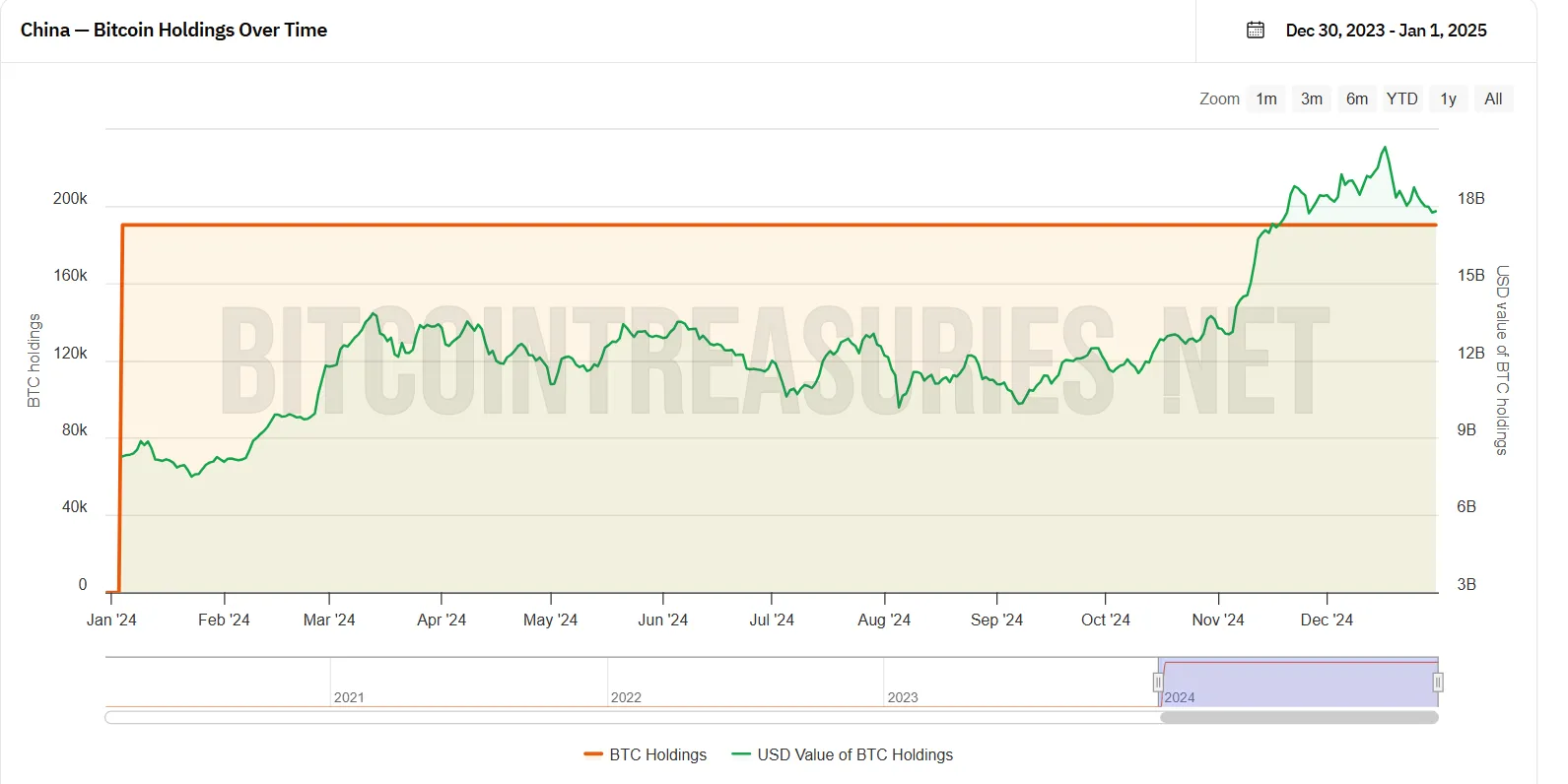

Regardless of its anti-crypto place, China holds greater than 190,000 BTC. This makes it the second-largest authorities holder of Bitcoin, following the US. China acquired the belongings by means of seizures linked to unlawful buying and selling actions.

Curiously, Justin Solar, founding father of the Tron blockchain, urged China to undertake a extra forward-thinking strategy to cryptocurrency coverage in July 2024.

“China should make further progress in this area. Competition between China and the US in Bitcoin policy will benefit the entire industry,” Solar stated.

Extra lately, a Chinese language court docket dominated that cryptoassets have “property attributes,” and Chinese language legislation doesn’t prohibit them outright. Nevertheless, these protections solely exist for crypto as a commodity, not as foreign money or enterprise instrument.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.