Chainlink (LINK) value has surged over 8% within the final 24 hours, with buying and selling quantity hovering by 106% to succeed in $1.04 billion.

Regardless of this robust value motion, whale exercise has stabilized, because the variety of addresses holding between 100,000 and 1,000,000 LINK has remained regular at 527 after a earlier peak of 534.

LINK Whales Hold the Impartial Stance

The variety of addresses holding between 100,000 and 1,000,000 LINK elevated considerably from 510 on December 18 to a month-to-month excessive of 534 on December 27. This surge in whale exercise highlights a interval of robust accumulation, reflecting heightened curiosity from giant traders throughout that point.

Monitoring such whale habits is essential, as their shopping for or promoting patterns can closely affect value traits. Whales’ accumulation typically indicators confidence within the asset and may drive additional value development, as their substantial trades create upward momentum.

Nevertheless, after reaching the height of 534 addresses, the quantity started to say no barely and has since stabilized at 527. This latest stabilization signifies that giant traders are presently neither considerably accumulating nor offloading their LINK holdings, suggesting a impartial sentiment.

Regardless of the 8% value surge within the final 24 hours, the dearth of continued whale accumulation might sign warning concerning the sustainability of the latest rally. For LINK value to keep up its upward trajectory, renewed curiosity and elevated exercise from these giant holders could also be mandatory to supply extra help.

Chainlink RSI Alerts Potential Restoration

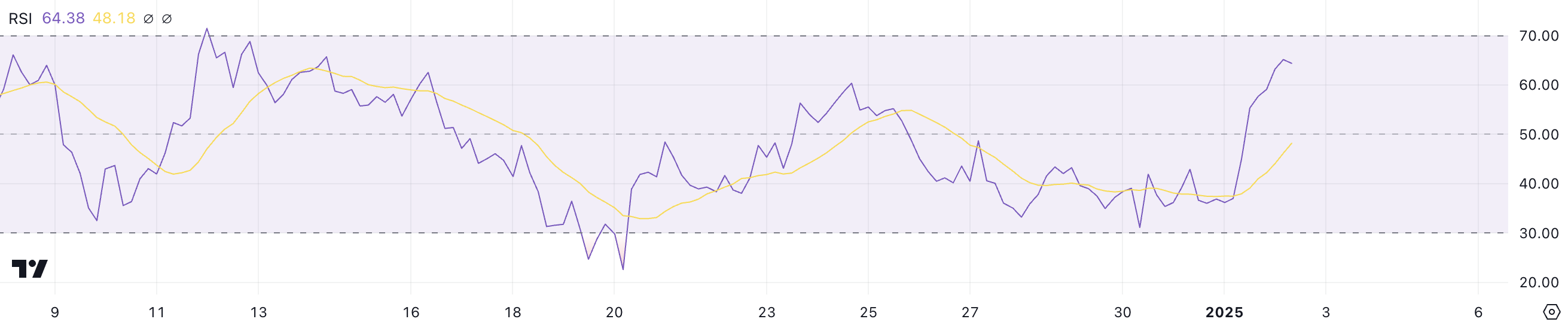

Chainlink Relative Energy Index (RSI) has skilled a pointy enhance, leaping from 36.9 to 64.3 inside only a single day. This speedy surge displays a major shift in momentum, pushed by robust shopping for strain following the latest value rally.

The RSI, a broadly used momentum indicator, measures the velocity and magnitude of value actions on a scale from 0 to 100, offering insights into whether or not an asset is overbought or oversold. Readings above 70 point out overbought situations, typically signaling a possible pullback, whereas readings beneath 30 counsel oversold situations and the opportunity of a restoration.

At 64.3, Chainlink RSI is nearing the overbought zone, indicating that whereas shopping for momentum stays robust, the asset is approaching a essential threshold the place upward motion could start to face resistance. Within the quick time period, this RSI degree means that LINK nonetheless has room for average positive aspects, however merchants ought to monitor for indicators of exhaustion because it nears 70.

If shopping for strain continues, the RSI might transfer into overbought territory, signaling the potential for a brief consolidation or correction earlier than additional value motion. Conversely, a stabilizing or declining RSI might point out that momentum is starting to weaken.

LINK Value Prediction: Can It Reclaim $30 In January?

Chainlink EMA strains are signaling the opportunity of a Golden Cross forming quickly. A golden cross is a bullish indicator that happens when a shorter-term EMA crosses above a longer-term EMA.

If this Golden Cross materializes and the present uptrend continues, LINK value might see vital upward momentum. The worth may check the resistance at $25.99, and a breakout above this degree might pave the best way for additional positive aspects. Targets at $27.46 and probably $30.94 might mark substantial development for the asset.

Then again, latest whale exercise and the elevated RSI counsel that the present surge is probably not fully sustainable, leaving room for a possible reversal.

If the uptrend falters and promoting strain will increase, LINK value might face a correction, testing its quick help at $21.32. Ought to this degree fail to carry, the value may drop additional to $20.02, signaling a deeper retracement.

Disclaimer

According to the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.