A latest report reveals that Konstantin Lomashuk and Vasiliy Shapovalov, co-founder of Lido—the biggest liquid staking protocol in Ethereum (ETH)—fund a competitor of Ethereum’s restaking protocol EigenLayer.

In keeping with a supply aware of this matter, Symbiotic is the protocol that can obtain Lido co-founder’s backing. It is going to get assist by means of the Cyber Fund.

Symbiotic Additionally Beneficial properties Backing from Paradigm

Along with Lido’s co-founders, Symbiotic has assist from Paradigm, a well known enterprise capital (VC) agency within the crypto business. Paradigm can also be one in all Lido’s primary traders.

The report additional reveals that Paradigm initially approached Sreeram Kannan, co-founder of EigenLayer, to spend money on the undertaking. Nonetheless, Sreeram Kannan rejected Paradigm’s provide and accepted funding from Andreessen Horowitz (a16z) as a substitute.

Since its introduction in October 2020, Lido has change into a breakthrough within the decentralized finance (DeFi) sector. It developed a protocol that enables customers to stake their ETH and obtain Lido Staked ETH (stETH) tokens, which can be utilized for numerous issues.

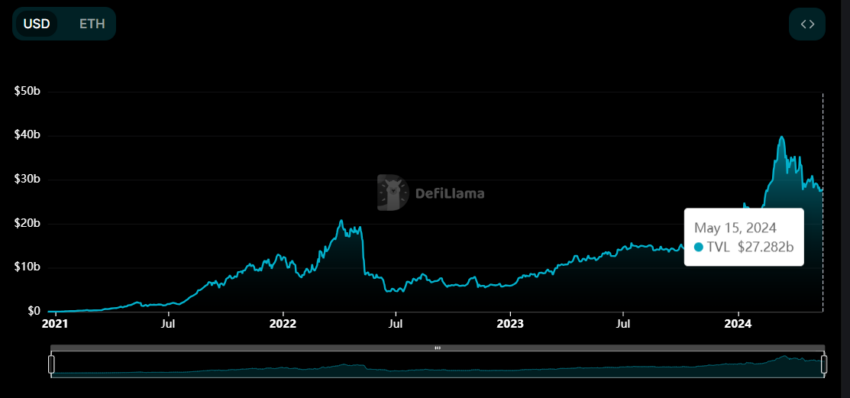

Lido has confirmed so standard that it’s now Ethereum’s largest DeFi protocol. In keeping with DeFiLlama information, Lido now has a complete worth locked (TVL) of $27.28 billion.

Learn extra: The Final Information to Lido Staked ETH (stETH)

In the meantime, EigenLayer is at the moment the second largest DeFi protocol with a TVL of $14.29 billion. Since EigenLayer achieved this determine comparatively shortly, its presence could threaten Lido. Due to this fact, it’s believable that Lido plans to again EigenLayer’s competitor to keep up its dominance.

How is Symbiotic Totally different from EigenLayer?

The report additionally defined how Symbiotic works. This protocol will probably be permissionless, offering a versatile mechanism for decentralized networks to coordinate node operators and financial safety suppliers.

“Symbiotic will offer a way for decentralized applications, called actively validated services, or “AVSs,” to collectively safe each other. Customers will be capable to restake property that they’ve deposited with different crypto protocols to assist safe these AVSs,” the report reads.

Not like EigenLayer, Symbiotic will allow customers to deposit any property based mostly on Ethereum’s ERC-20 token customary straight into its protocol. This means Symbiotic will probably be straight appropriate with stETH and 1000’s of different crypto tokens that use the ERC-20 token customary.

In the meantime, EigenLayer at the moment accepts ETH property, a number of ETH-linked liquid staking tokens (LST), and native EIGEN tokens. Nonetheless, Symbiotic won’t settle for ETH deposits in any respect. As a substitute, it permits customers to stake utilizing stETH and different standard property that aren’t natively appropriate with EigenLayer.

Nonetheless, it stays to be seen when Symbiotic will launch. Some sources mentioned this undertaking can be launched on the finish of 2024.

Certainly, restaking is likely one of the most attention-grabbing crypto narratives in 2024. A latest report from CoinGecko famous that EigenLayer’s restaking contributed to the Ethereum ecosystem’s achievement in Q1 2024.

Within the quarter, restaking on EigenLayer elevated by 36%, with a complete of 4.3 million ETH being restaked. The vast majority of restaked ETH was held by Liquid Restaking Protocols (LRTs), which amounted to 2.28 million ETH.

Learn extra: Ethereum Restaking: What Is It And How Does It Work?

The attract of restaking extends past Ethereum. BeInCrypto beforehand reported that Jito, a liquid staking protocol on Solana, was rumored to create its restaking companies.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.