Based on FxPro senior market analyst Alex Kuptsikevich, the crypto market has been comparatively stagnant, displaying a decline in market cap till at present’s enhance.

Ethereum (ETH) trades at $2,977.88, a 2.6% enhance over the previous 24 hours. Its market cap has grown by 2.64% to over $357 billion, staying the second-largest cryptocurrency.

Kuptsikevich highlighted Ethereum’s challenges, noting its ongoing consolidation close to the decrease finish of its value vary and a “death cross” beneath its 200-day common, suggesting potential longer-term declines. This distinction between the short-term enhance and the analyst’s medium-term issues reveals the complexities of market predictions.

Equally to Ethereum, Cardano (ADA) has seen a 2.43% rise in its value to $0.4461, with its market cap growing by 2.42%. Positioned as one of many 10 largest cryptos, ADA’s buying and selling close to the decrease finish of its vary suggests a cautious outlook regardless of the current uptick, mirroring Ethereum’s consolidation pattern.

Litecoin’s (LTC) value has elevated by 1.81% to $80.98, and its market cap has risen by 1.82%. Because the nineteenth largest cryptocurrency, LTC continues to check its 200-day common, indicating a possible ongoing wrestle to regain stronger bullish momentum. Based on Kuptsikevich, Litecoin might face a protracted interval of bearish tendencies if it fails to reclaim greater ranges quickly.

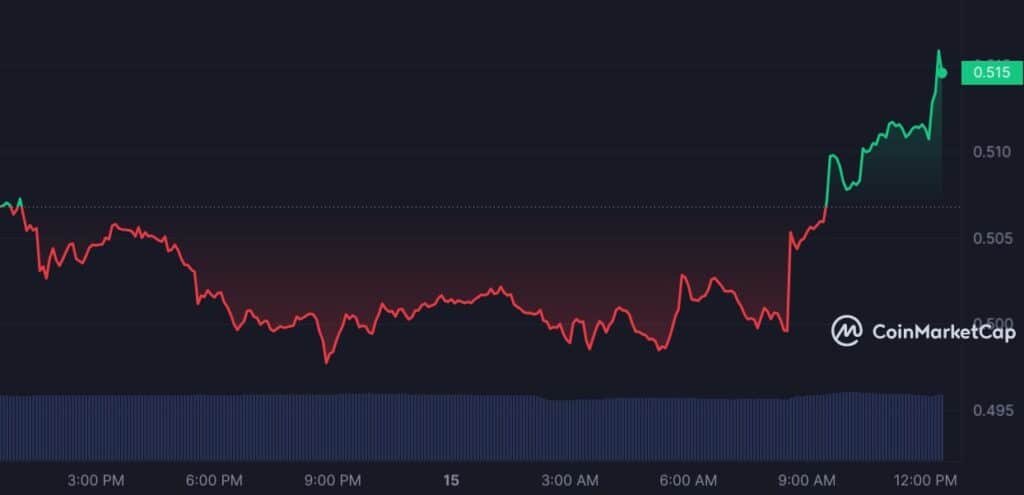

XRP is buying and selling round a traditionally vital stage of $0.50 after shedding key help earlier in April.

“XRP broke below an upward support line, transforming it into resistance for subsequent peaks. This sets up a bearish scenario, potentially pulling back to long-term support at $0.25-30,” Kuptsikevich remarked, suggesting a cautious strategy for buyers.

XRP’s modest value enhance of 1.57% to $0.5135 contrasts with a minor 0.56% enhance in market cap. The seventh largest crypto, XRP’s break beneath key help ranges earlier within the month factors to a difficult street forward regardless of some restoration, as indicated by the analyst.

In distinction, Solana (SOL) reveals speculative potential, with predictions by Merkle Tree Capital suggesting an increase to $400 by November 2024, pushed by meme coin recognition linked to the U.S. election marketing campaign.

For the reason that Merkle Tree evaluation, SOL has proven a notable surge. Its value has elevated by 7.54% to $152.76, whereas its market cap has expanded by 7.53%, making it the fifth largest cryptocurrency.

Whereas the short-term information from CoinMarketCap reveals promising good points for these cryptocurrencies from U.S. inflation information, the medium-to-long-term analyses by Kuptsikevich paint a extra nuanced image that might be affected by different exterior economics.