Millennium Administration, a worldwide funding agency with over $60 billion in property, has disclosed its vital Bitcoin exchange-traded fund (ETF) holdings for the primary quarter of 2024.

In accordance with a latest 13F submitting with the Securities and Alternate Fee (SEC), Millennium holds roughly $1.9 billion in varied US-traded spot Bitcoin ETFs.

Institutional Bitcoin ETF Investments Surge

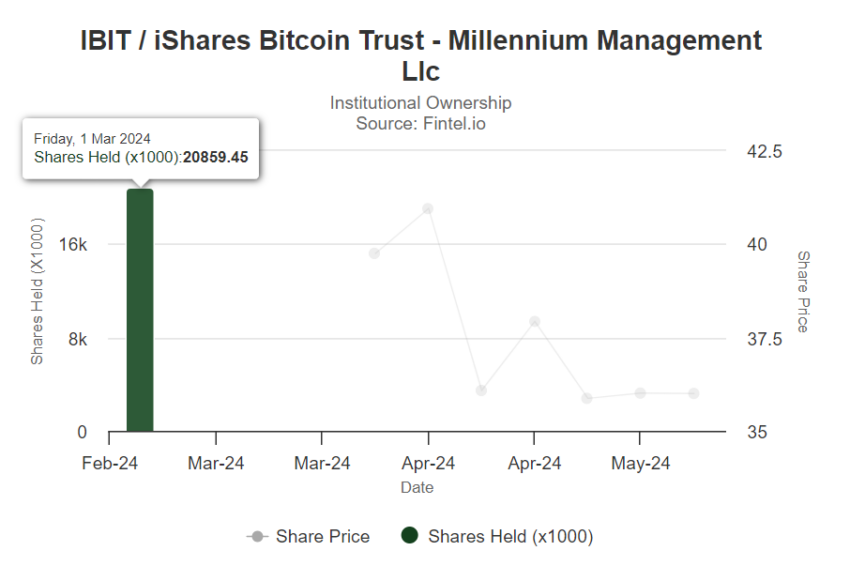

The agency’s largest holdings embrace BlackRock’s iShares Bitcoin Belief (IBIT), Constancy’s Sensible Origin Bitcoin Fund (FBTC), and the Grayscale Bitcoin Belief ETF (GBTC). As well as, Millennium holds smaller stakes within the ARK 21Shares Bitcoin ETF (ARKB) and the Bitwise Bitcoin ETF (BITB). Particularly, the submitting particulars Millennium’s investments as $844.2 million in IBIT, $806.7 million in FBTC, $202 million in GBTC, $45 million in ARKB, and $44.7 million in BITB.

Different outstanding asset managers are additionally rising their Bitcoin ETF holdings. Pine Ridge reported $205 million in IBIT, FBTC, and BITB. In the meantime, Schonfeld Strategic Advisors disclosed $248 million in IBIT and $231.8 million in FBTC, totaling $479 million.

Matt Hougan, Chief Funding Officer at Bitwise, highlighted the vital development of institutional funding in Bitcoin ETFs. In accordance with Hougan, roughly 563 skilled funding corporations reported proudly owning $3.5 billion value of Bitcoin ETFs final Thursday. By the submitting deadline, he anticipates that the market might even see over 700 skilled corporations and complete property underneath administration (AUM) approaching $5 billion.

“This is absolutely massive. For any financial advisor, family office, or institution wondering if they were the only one considering Bitcoin exposure, the answer is clear: You are not alone,” Hougan affirmed.

Hougan in contrast the curiosity in Bitcoin ETFs to that of gold ETFs launched in 2004, which had been thought-about extremely profitable. Gold ETFs attracted over $1 billion of their first 5 days, with simply 95 skilled corporations invested on the preliminary 13F submitting.

“From a breadth of ownership perspective, the Bitcoin ETFs are a historic success,” he mentioned.

Though most Bitcoin ETF investments are at the moment from retail traders, Hougan famous a possible for a rising development amongst establishments. As an example, Hightower Advisors has $68 million allotted to Bitcoin ETFs, simply 0.05% of their property. Hougan predicts that such allocations will improve over time, probably reaching vital proportions inside institutional portfolios.

“Multiply that by the growing number of professional investors participating in the space, and you can begin to see what’s behind my enthusiasm,” he defined.

Certainly, substantial investments by establishments like Millennium Administration underscore the rising integration of cryptocurrency into mainstream monetary portfolios. This elevated institutional backing indicators long-term confidence in digital property’ potential, probably paving the way in which for broader crypto adoption.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.