Brian Armstrong, CEO of Coinbase, has known as Bitcoin a greater type of cash than gold, citing its shortage, portability, divisibility, utility, and efficiency.

Armstrong’s feedback adopted the South African Reserve Financial institution (SARB) Governor Lesetja Kganyago’s opposition to establishing a Strategic Bitcoin Reserve (SBR). Kganyago argued towards the notion, questioning Bitcoin’s strategic worth as a government-held asset.

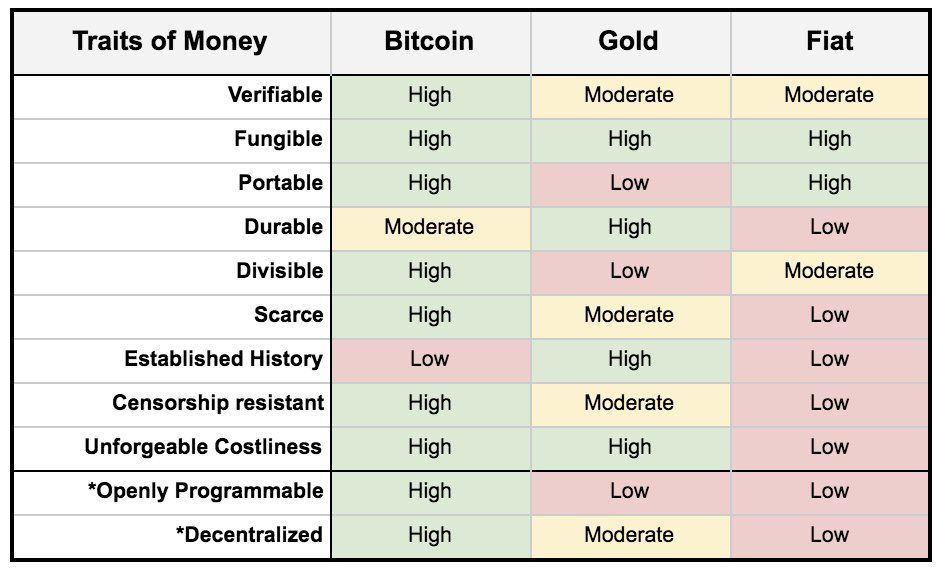

Coinbase CEO on Bitcoin vs. Gold

In a latest publish on X (previously Twitter), Armstrong elaborated on Bitcoin’s benefits over gold.

“Bitcoin is a better form of money. It has the decentralization and scarcity of gold, but better divisibility, portability, and (i think) even fungibility. It’s relatively harder to tell if gold is pure, or contains some lead in the middle of the bar,” Armstrong wrote.

He famous that Bitcoin’s market capitalization, roughly $2 trillion, represents 11% of gold’s market cap, which is round $18 trillion. The CEO expressed confidence that Bitcoin’s market cap may surpass gold throughout the subsequent 5-10 years, finally making Bitcoin reserves extra important than gold reserves.

Subsequently, he argued that nations with gold reserves ought to take into account allocating at the very least 11% of these reserves to Bitcoin.

“If the US leads here with a Strategic Bitcoin Reserve, I think many of the G20 will follow,” he added.

His detailed publish adopted the dialogue on the World Financial Discussion board in Davos, the place Kganyago expressed skepticism about governments holding Bitcoin reserves.

The SARB governor dismissed the thought of lobbying for a specific asset with out strategic intent. Furthermore, Kganyago emphasised gold’s historic priority as a retailer of worth.

“There is a history to gold, there was once a gold standard, currencies were pegged to gold. But if we now say Bitcoin, then what about platinum or coal? Why don’t we hold strategic beef reserves, or mutton reserves, or apple reserves? Why Bitcoin?,” Kganyago questioned.

He described the controversy as a public coverage problem that requires broader engagement, warning towards industries pushing their merchandise onto society.

In response, Armstrong highlighted Bitcoin’s monitor report because the best-performing asset over the past decade. He emphasised that governments ought to take into account Bitcoin as a retailer of worth and step by step enhance their holdings over time.

“It might start with being 1% of their reserves but over time, it will come to be equal or greater than gold reserves,” Armstrong urged.

In the meantime, SBR continues to achieve traction. States like Wyoming, Massachusetts, Oklahoma, and Texas have launched payments to undertake Bitcoin as a strategic asset.

Moreover, at the very least 15 US states, together with Ohio and Pennsylvania, are actively contemplating measures to determine Bitcoin reserves. President Donald Trump additionally signed an govt order to create a “national digital asset stockpile.” This transfer has paved the way in which for a extra formalized method to integrating digital property into the nation’s monetary technique.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.