Bitcoin (BTC), the main crypto, is grappling with challenges after failing to shut above the essential $105,000 resistance degree. This value level has acted as a ceiling for BTC, stopping additional upward motion.

The state of affairs worsened as long-term holders (LTHs) opted to liquidate their positions, including to promoting strain and pushing the worth decrease.

Bitcoin Buyers Lose Endurance

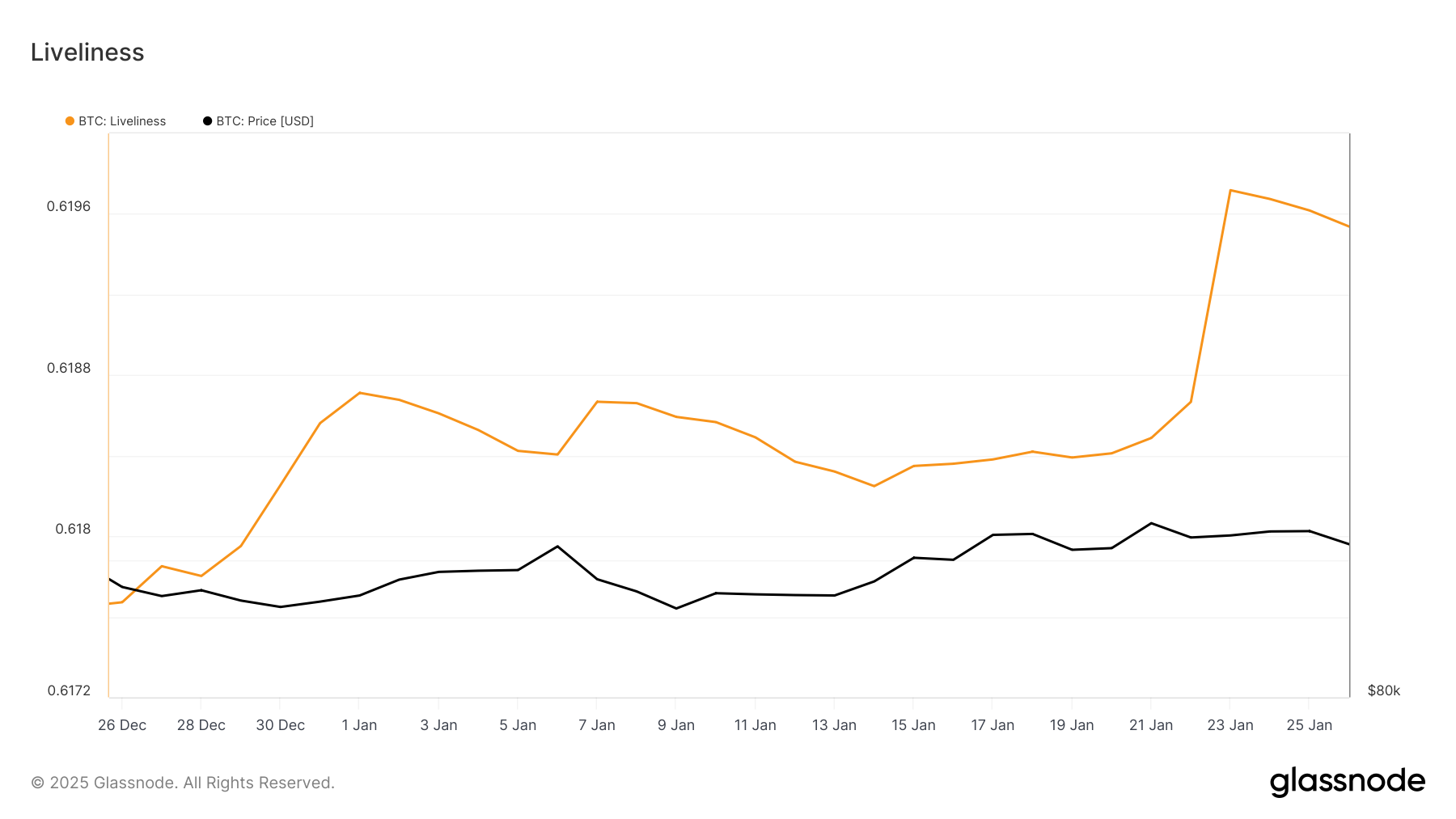

Current knowledge signifies a pointy uptick in Bitcoin’s Liveliness, a metric that tracks the exercise of long-term holders. This spike means that many LTHs have offered their holdings over the previous few days. Supporting this statement is the shift in LTH balances and an increase in total Coin Days Destroyed, signaling important motion of beforehand dormant BTC.

Since LTHs are sometimes seen because the spine of Bitcoin’s stability, their promoting has traditionally resulted in bearish outcomes. This pattern has performed out over the weekend and into at present, contributing to the continued value decline.

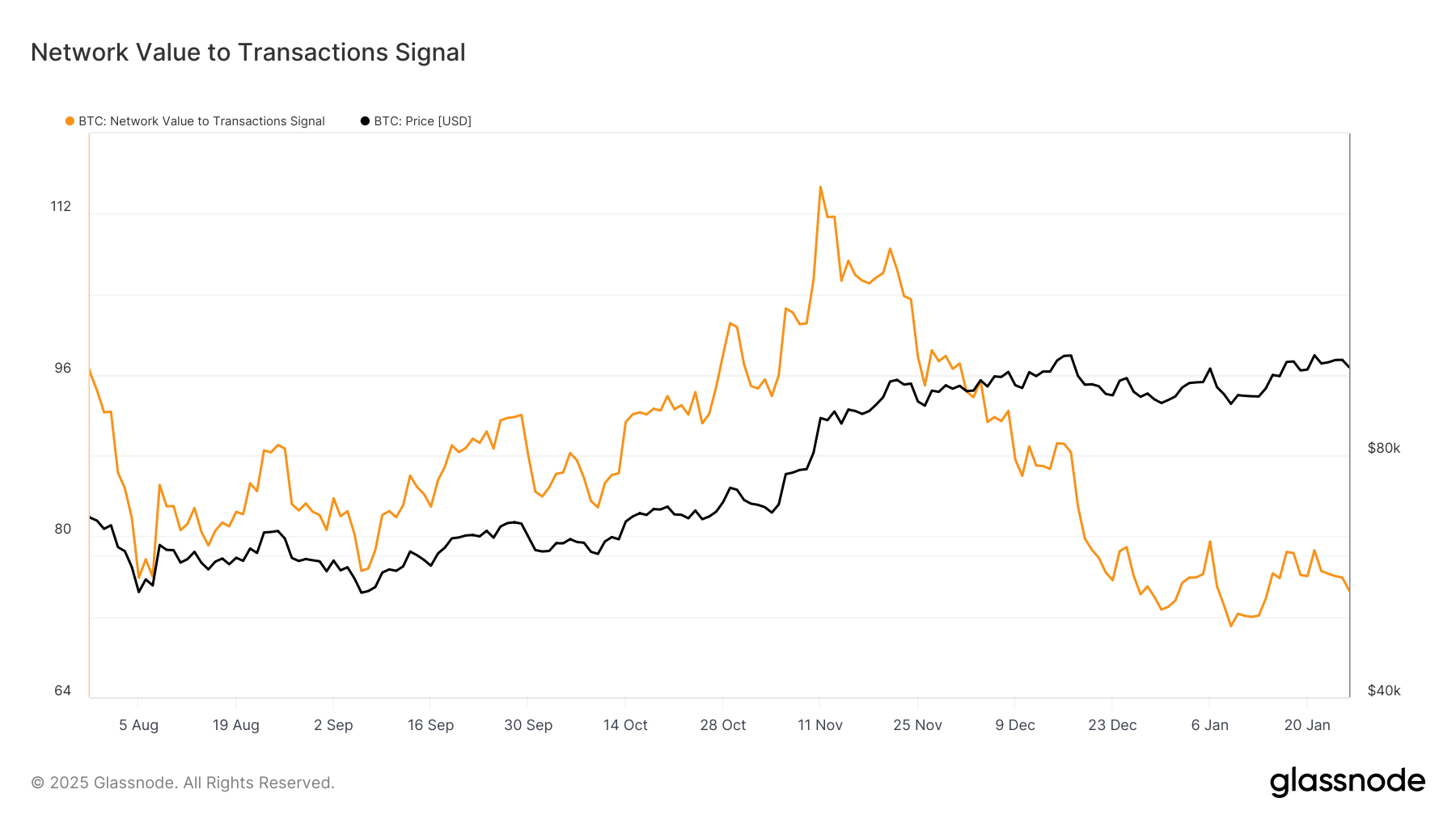

Regardless of the downturn, Bitcoin’s macro momentum suggests room for restoration. The Community Worth to Transaction (NVT) Sign, a key valuation indicator, is at the moment at a low. This factors to Bitcoin being undervalued in comparison with its transaction exercise, hinting on the potential for future development.

Whereas the NVT sign gives a optimistic outlook, broader market cues might want to align for BTC to regain power. Buyers usually are not explicitly bearish for the time being, suggesting that sentiment may enhance rapidly if supportive situations come up, akin to elevated shopping for exercise or favorable financial developments.

BTC Worth Prediction: Stopping Losses

Bitcoin’s value has fallen by 3.88% during the last 24 hours, bringing it to $100,682. This drop was primarily pushed by LTH liquidations and BTC’s lack of ability to shut above the $105,000 resistance degree, reinforcing bearish sentiment within the brief time period.

The following key help lies at $100,000, a important psychological and technical degree. BTC is more likely to bounce off this help or settle right here briefly. Nevertheless, shedding this degree may ship the cryptocurrency right down to $95,668, amplifying losses and deepening bearish strain.

Conversely, if broader market situations enhance and Bitcoin reclaims $105,000 as help, the bearish outlook might be invalidated. In such a situation, BTC may push towards its all-time excessive (ATH) of $109,699, reinvigorating investor confidence and paving the way in which for a brand new rally.

Disclaimer

In step with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.