VIRTUAL worth is present process a pointy correction, dropping 58.7% within the final 30 days and 15% prior to now 24 hours. Its market cap now sits at $1.23 billion, marking a major decline as bearish momentum strengthens.

Technical indicators replicate this weak point, with ADX rising, confirming the downtrend, whereas BBTrend stays unfavourable regardless of some enchancment. As VIRTUAL continues buying and selling beneath $2, the subsequent transfer will rely on whether or not it may well break resistance and recuperate or lose help and lengthen its decline.

VIRTUAL ADX Reveals the Present Downtrend Is Getting Stronger

One of many main AI agent tokens, Virtuals Protocol, has sustained a week-long decline pushed by the newest DeepSeek hype. The token’s ADX (Common Directional Index) is presently at 22.5, rising from 15.3 only a day in the past, indicating a strengthening development.

The ADX measures the power of a development on a scale from 0 to 100, with readings beneath 20 signaling a weak development and above 25 confirming a robust one.

Values between 20 and 25 recommend a transition section, the place momentum is constructing however not but totally established.

With VIRTUAL in a downtrend, the rising ADX means that bearish momentum is intensifying. If ADX continues growing above 25, it will affirm that the downward development is gaining power, making a restoration tougher.

Nonetheless, if ADX stabilizes or begins declining, it might point out that promoting stress is weakening, doubtlessly permitting the value to consolidate or reverse.

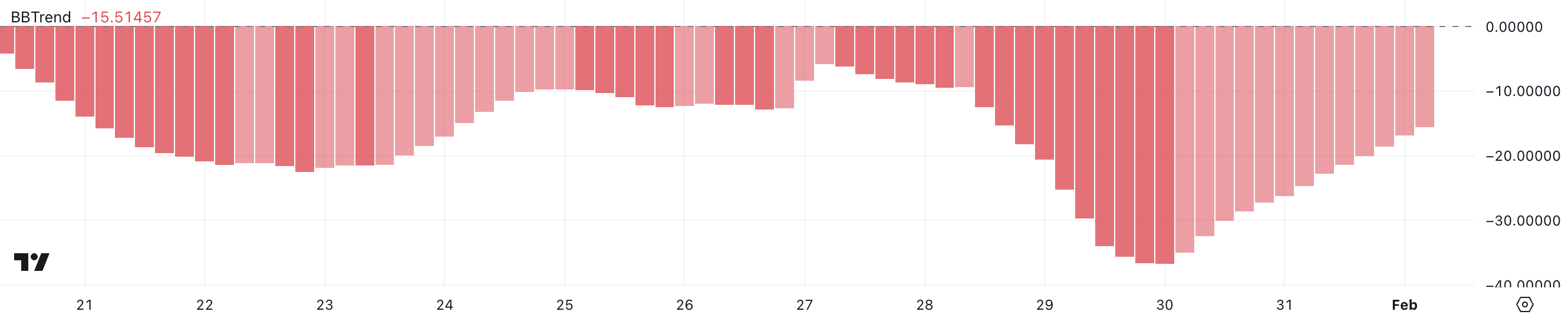

VIRTUAL BBTrend Has Been Damaging Since January 20

VIRTUAL’s BBTrend is presently at -15.5, having remained unfavourable since January 20, with a unfavourable peak of -36.5 on January 30.

BBTrend (Bollinger Band Development) is an indicator that measures development power and course based mostly on Bollinger Bands. Optimistic values point out an uptrend, whereas unfavourable values sign a downtrend, with extra excessive readings suggesting stronger momentum in both course.

Though nonetheless unfavourable, VIRTUAL‘s BBTrend improved from -36.5 to -15.5. This means that the downtrend is weakening. If BBTrend continues rising towards impartial (0), it might point out that promoting stress is fading, permitting for stabilization or potential restoration.

Nonetheless, if the BBTrend turns decrease once more, it will affirm that the bearish development stays robust, growing the chance of additional draw back.

VIRTUAL Value Prediction: Will VIRTUAL Proceed Buying and selling Beneath $2?

VIRTUAL worth is presently buying and selling inside a spread between help at $1.77 and resistance at $1.99, with worth motion displaying indicators of consolidation. If the $1.99 resistance is damaged, it might sign the beginning of a stronger uptrend, pushing VIRTUAL towards $2.22 and $2.42 as the subsequent key ranges.

A resurgence in crypto AI brokers hype might additional gasoline momentum, doubtlessly resulting in a restoration towards $3.14, a stage not seen in latest weeks.

However, if help at $1.77 fails, VIRTUAL worth might lengthen its downtrend, with $1.35 as the subsequent main stage to observe.

This may mark its lowest worth since December 9, 2024, reinforcing bearish sentiment and making VIRTUAL much more distant from different AI cash, similar to RENDER, FET, and TAO, in market cap.

Disclaimer

In keeping with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.