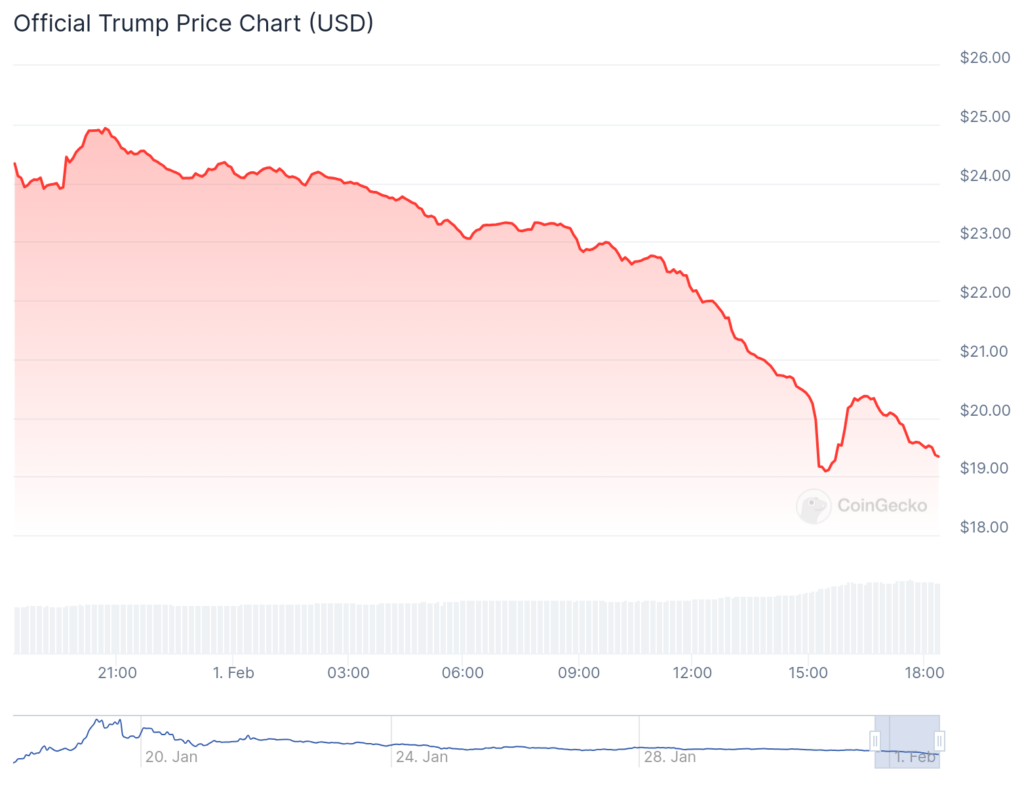

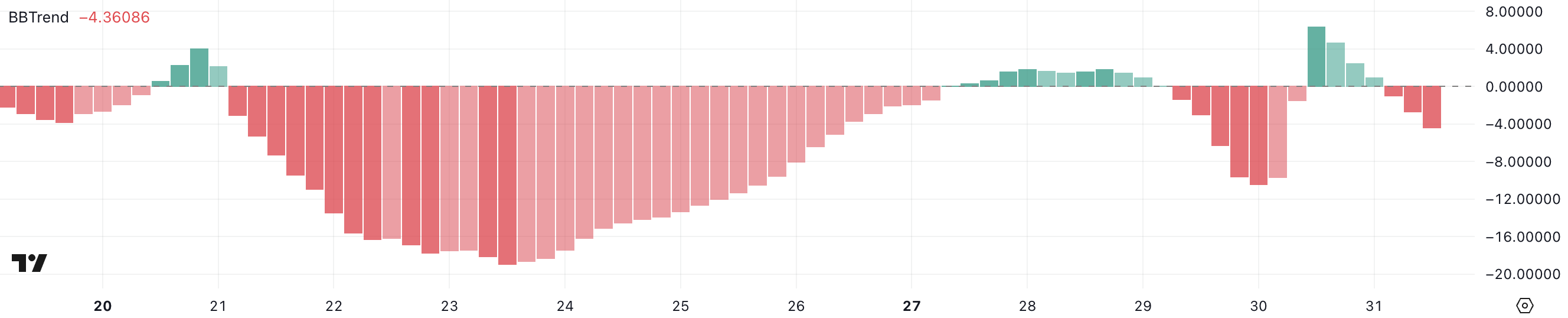

The Official Trump meme coin reached its all-time excessive of $75.35 on Jan. 19, 2025, shortly after its launch on Jan. 17 — three days earlier than Donald Trump’s second time period as U.S. president started. Since then, the coin’s worth has fallen off a cliff.

As of Feb. 1, TRUMP is buying and selling at roughly $19.38. That’s nearly a 74% plummet from its peak.

The coin’s market capitalization stays substantial, with a completely diluted valuation of round $2 billion (80% of the tokens are held by Trump Group associates).

SkyBridge Capital founder Anthony Scaramucci — a Trump ally-turned-critic — is asking out the president for what he alleges is a pump-and-dump scheme.

“President Trump posted on Truth Social last night in an attempt to ‘pump’ his $TRUMP memecoin (yes that’s a real sentence that many have normalized),” Scaramucci posted Saturday on X. “The result has been an acceleration of the ‘dump,’ now down 70% from its peak. The jig is up.”

Wall Road apprehensive?

Trump, who owns Reality Social by way of his firm Trump Media & Expertise Group, ceaselessly hawks objects on his private account (i.e., non-fungible tokens, or NFTs).

And, in September, Trump helped promote World Liberty Monetary, a decentralized finance platform for buyers to borrow and lend utilizing cryptocurrencies. He and his sons aren’t thought of house owners of the corporate, however they’ve an settlement to be paid for selling it, in accordance with the New York Instances.

The Official Trump meme coin is simply the most recent money-making try (MAGA-branded bibles and sneakers had been additionally promoted).

Scaramucci, whose hedge fund was among the many first to delve into crypto again in 2020, posed a query to his 1 million-plus followers on X: “Could someone please explain to me on Crypto X How the President pumping his own meme coin is a good thing?”

Scaramucci, who began his profession at Goldman Sachs, isn’t the one Wall Road professional scrutinizing the now meshed-together world of cryptocurrency and Trump’s White Home (Melania has an official meme coin, too).

In accordance with the Monetary Instances, a memo from New York-based hedge fund Elliott Administration means that Trump’s heat embrace of digital cash is fueling a speculative frenzy that might “wreak havoc.”

The irony? Elliott’s founder, Paul Singer, is not any stranger to Trump-world. Regardless of being a longtime crypto critic, he donated $56 million to conservative candidates in 2024, together with $5 million to the “Make America Great Again” PAC.

Since Trump’s election, Bitcoin has shot previous $100,000, fueled by his vow to make America “the Bitcoin superpower of the world.” Not one to overlook a chance, Trump wasted no time signing an govt order to advertise a nationwide crypto stockpile.

In the meantime, Elliott’s memo questions why the U.S. would encourage alternate options to the greenback at a time when different nations are scrambling to ditch it.