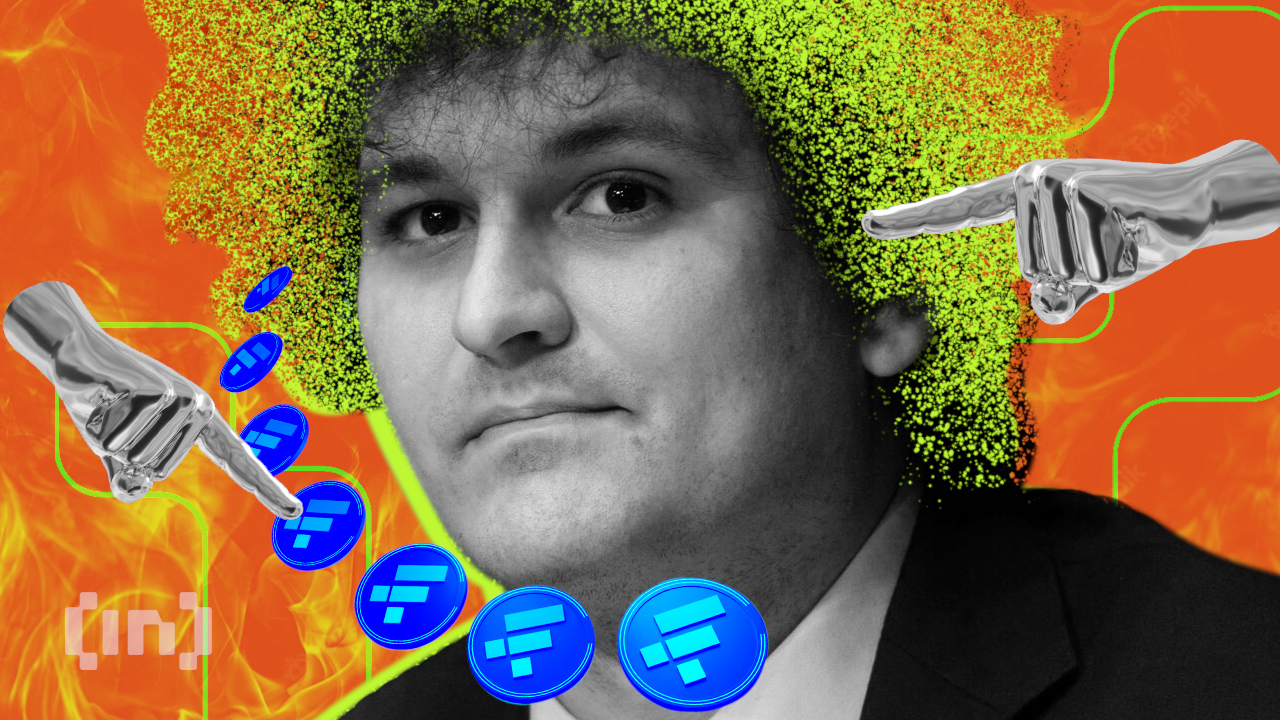

FTX founder Sam Bankman-Fried (SBF) has intensified efforts to overturn his fraud conviction by responding to the US authorities’s dismissal of his attraction.

His authorized crew argues that the trial was flawed attributable to suppressed proof, and he deserves one other probability below a special choose.

Sam Bankman-Fried Argues FTX Clients Misplaced Nothing

In a January 31 court docket submitting, Bankman-Fried insisted that his trial was unfair, claiming judicial bias influenced the result.

SBF attorneys assert within the submitting that FTX prospects didn’t expertise monetary losses. They emphasize that collectors will get better greater than their preliminary losses, pointing to FTX’s investments in companies like Anthropic, Solana, and Mysten Labs.

His attraction highlighted how an early funding in Anthropic helps FTX collectors get better funds. Bankman-Fried purchased a considerable stake within the AI firm for about $500 million.

Since then, the corporate’s worth has grown to $60 billion, considerably growing the worth of his funding. His protection introduced this as proof of his sound monetary choices, asserting that the investments may have ultimately restored FTX’s solvency.

“Consider Anthropic. Bankman-Fried invested early in Anthropic—purchasing a substantial share for approximately $500 million. The company is now worth $60 billion, earning a return multiples over. His investment was brilliant,” his attorneys acknowledged.

One other key facet of his attraction is the declare that the court docket suppressed essential proof. He contends that he formed FTX’s insurance policies based mostly on authorized counsel.

Nevertheless, the court docket blocked him from presenting proof that attorneys had authorized his choices.

His authorized crew additionally accuses Sullivan & Cromwell (S&C), FTX’s authorized representatives, of conflicts of curiosity. They declare S&C was deeply concerned in FTX’s operations earlier than its collapse but solely categorized asset commingling as against the law after the alternate’s downfall.

The attraction additional alleges that the legislation agency contacted prosecutors with out informing Bankman-Fried, successfully setting the stage for his indictment.

“Instead of recusing itself, S&C suddenly claimed this commingling was a crime after the November 2022 run on deposits. S&C then affirmatively reached out to prosecutors without notifying Bankman-Fried, its then-client-to invite this prosecution,” the attorneys argued.

Moreover, SBF’s authorized crew disputes the court docket’s choice ordering him to repay over $11 billion, calling the ruling “unlawful” and “indefensible.” They argue that he has already surrendered all his belongings and can’t presumably meet the imposed monetary penalties.

“There is zero chance Bankman-Fried—who already turned over all his assets—could ever repay $11,020,000,000, or anything close,” his attorneys wrote.

Sam Bankman-Fried’s newest attraction comes amid hypothesis that his dad and mom are exploring methods to safe a presidential pardon. In the meantime, FTX collectors proceed to await repayments because the chapter course of continues.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.