Analysts have elevated their odds of spot Ethereum exchange-traded fund (ETF) approval. This shift in sentiment comes amid renewed optimism about regulatory approval from the US Securities and Trade Fee (SEC).

The transfer indicators a possible breakthrough within the extended quest for a spot Ethereum ETF.

Renewed Optimism for Spot Ethereum ETF Approval

Eric Balchunas and James Seyffart, ETF analysts at Bloomberg Intelligence, just lately introduced that they’re growing their odds of spot Ethereum ETF approval from 25% to 75%. Balchunas defined the rationale behind their renewed optimism.

“Hearing chatter this afternoon that the SEC could be doing a 180 on this increasingly political issue, so now everyone scrambling. But again, we capping cat 75% until we see more, e.g., filing updates,” Balchunas wrote on his X (Twitter) account.

The SEC reportedly requested asset managers that wish to listing spot Ethereum ETFs to replace 19b-4 filings forward of the deadline this week. This transfer has sparked hypothesis and exercise throughout the business as stakeholders anticipate potential approval.

Learn extra: Ethereum ETF Defined: What It Is and How It Works

Balchunas additionally referred to an announcement from ETF Retailer’s Nate Geraci. BeInCrypto reported that Geraci predicted the “SEC to approve 19b-4s & then slow play S-1s.”

The 19b-4 filings suggest rule adjustments essential for itemizing new merchandise, like spot Bitcoin or Ethereum ETFs, on inventory exchanges. In the meantime, S-1 registration kinds present detailed details about new securities supplied to the general public, together with the fund’s construction, administration, and funding technique. You will need to observe that the issuers should get approval for each kinds to formally launch the ETFs available in the market.

Nonetheless, Seyffart famous that their elevated odds are just for “the 19b-4 May 23 deadline,” referring to VanEck’s spot Ethereum ETFs approval.

“It could be weeks to months before we see S-1 approvals and, thus, a live Ethereum ETF,” Seyffart added.

This growth is especially fascinating on condition that each Seyffart and Balchunas had been lowering their odds for the previous months. Furthermore, distinguished figures within the business, together with Jan van Eck, CEO of asset supervisor VanEck, have expressed their pessimism on the spot Ethereum ETF approval.

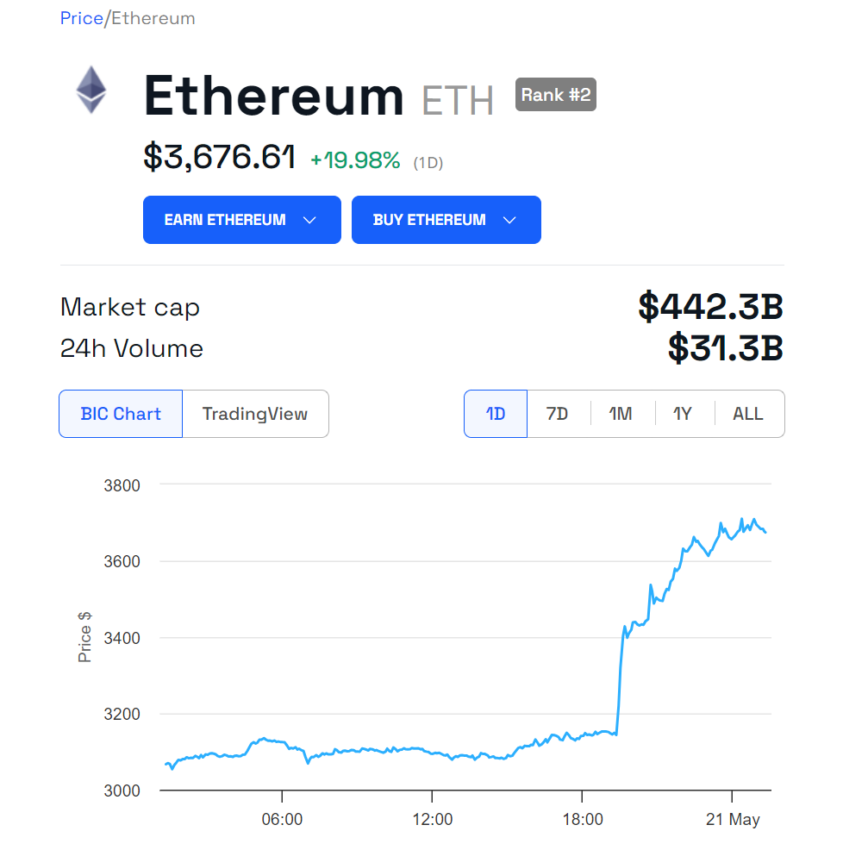

Following this information, Ethereum’s (ETH) value has considerably elevated. Based on BeInCrypto’s knowledge, ETH’s value has surged by 19.98% within the final 24 hours. On the time of writing, ETH is now buying and selling at $3,676.

Learn extra: The right way to Put money into Ethereum ETFs?

The market optimism extends to Ethereum betas—altcoins below the Ethereum ecosystem—together with Polygon (MATIC) and Optimism (OP). For the final 24 hours, MATIC and OP costs have risen 9.4% and 19.7%, respectively.

General, this heightened likelihood of approval has infused the market with renewed enthusiasm. As the SEC’s choice looms, business stakeholders are carefully monitoring updates.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.