The cryptocurrency market is abuzz with anticipation over the potential approval of a spot Ethereum ETF by the US Securities and Alternate Fee (SEC).

Daniel Yan, co-founder of Matrixport, believes Solana (SOL) could possibly be subsequent in line.

Solana Could be the Subsequent ETF Approval

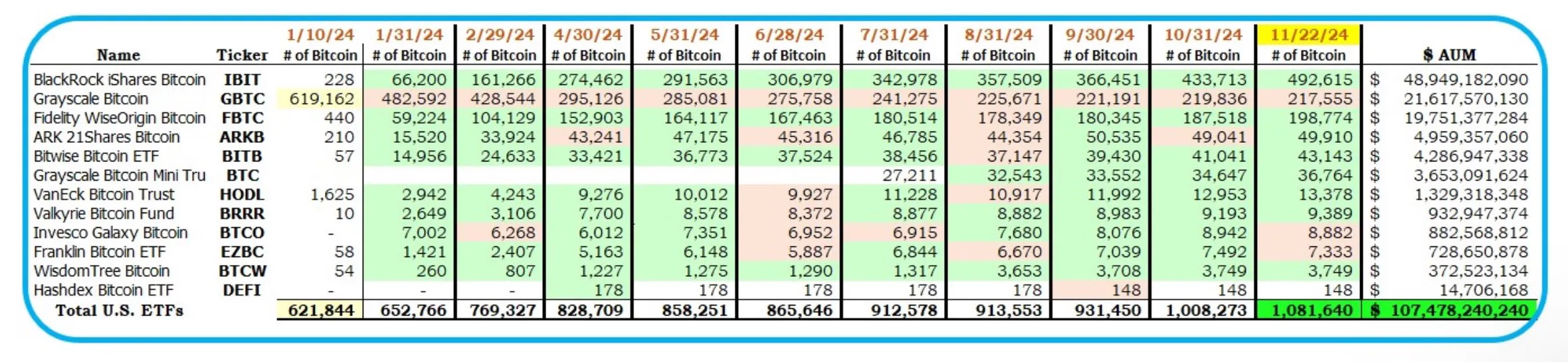

Because the SEC’s choice on a spot Ethereum ETF looms, hypothesis is rife about which cryptocurrency is likely to be subsequent. Daniel Yan believes Solana is a major candidate, probably benefiting from Ethereum’s anticipated success: he attracts parallels to the Bitcoin ETF approval, which boosted Ethereum’s worth and market curiosity.

Certainly, the launch of the spot BTC ETF within the US led to a 12% enhance within the ETH/BTC pair inside per week. Matrixport co-founder suggests Solana may expertise related momentum.

Сrypto group members are additionally actively speculating that the approval of a spot Ethereum ETF will inevitably result in functions for ETFs on different altcoins. Fashionable crypto analyst Ted additionally hinted at the opportunity of spot the ETF filings shortly.

“The market is certainly not priced for this… if it’s approved, get ready for all kinds of spot altcoin filings. cough, cough SOL,” he remarked.

Then again, some specialists imagine that submitting for a spot ETF for Solana is likely to be difficult as a result of SOL futures ETF just isn’t but listed. In contrast to Bitcoin and Ethereum, which had actively buying and selling futures ETFs on the time of their spot ETF approvals, Solana lacks this essential step, probably hindering its fast consideration for a spot ETF.

“It is natural for the crypto sphere to be excited about the potential of Solana ETF to be listed, but this would be a major stretch. There are no futures listed on Solana. If anything, the ones surprisingly ahead of Solana, by virtue of these being listed on CFTC-regulated Coinbase Derivatives, are BCH, LTC, and yes Doge ( not a surprise, fair launch POW chains),” Dimitrios Kavvathas, Founding father of Ithaca instructed BeInCrypto.

Whereas no Solana ETFs are presently accepted within the US, alternate options just like the Grayscale Solana Belief (GSOL) and merchandise corresponding to VanEck’s Solana ETN and 21Shares’ Solana ETP supply publicity to SOL costs, albeit via derivatives. These merchandise present traders with oblique methods to commerce SOL, reflecting its worth actions.

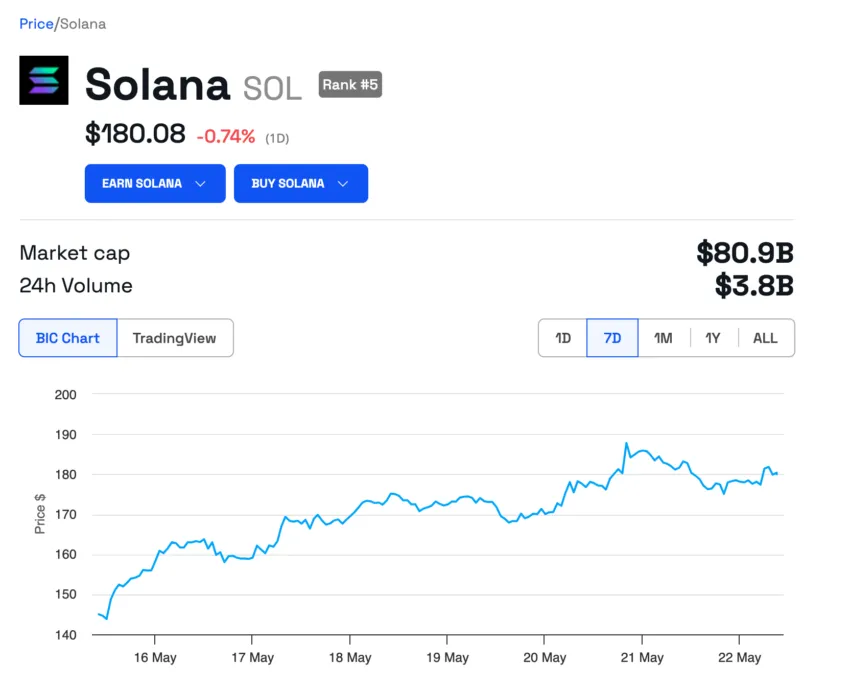

Over the previous week, SOL has surged by greater than 23%, indicating heightened curiosity and hypothesis. This spectacular rise displays rising investor confidence and anticipation surrounding Solana’s potential.

Learn extra: Solana (SOL) Worth Prediction 2024/2025/2030

With the precise regulatory surroundings, it may quickly be part of Bitcoin and Ethereum in reaching ETF approval, marking a turning level in its growth. Whereas challenges stay, the optimism from business leaders like Daniel Yan confirms that daring predictions can change into actuality.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.