Current important Ethereum (ETH) transfers to cryptocurrency exchanges have caught the market’s consideration. This transfer has raised hypothesis about potential profit-taking, portfolio rebalancing, or market hypothesis.

These developments coincide with the US Securities and Alternate Fee (SEC) nearing a call on the Vaneck Ethereum exchange-traded fund (ETF), which has heightened expectations throughout the business.

Traders Switch ETH to Exchanges

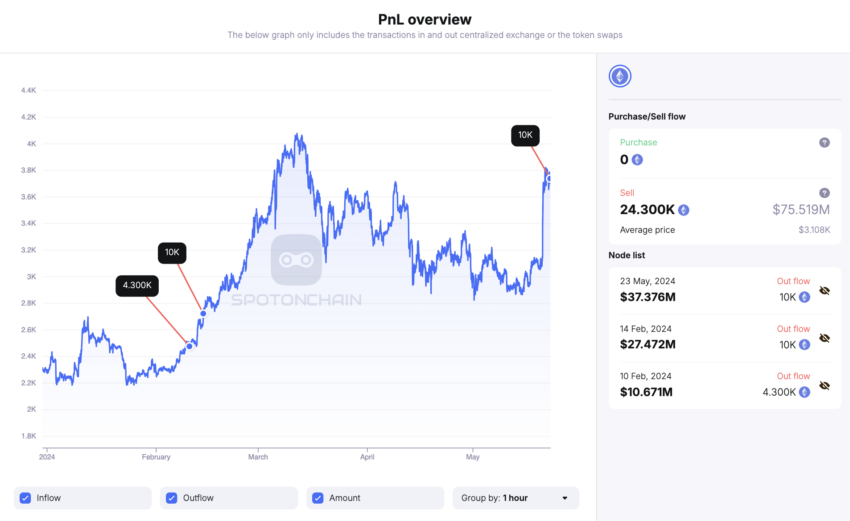

Jeffrey Wilke, one of many founders of Ethereum, has transferred 10,000 ETH, price round $37.38 million, to the cryptocurrency alternate Kraken. Whereas the motive behind such a big switch is unclear, just a few hypotheses may be derived from it.

- Revenue Taking: Wilke could also be promoting off his tokens to appreciate earnings. This could possibly be as a result of reaching his desired return on funding or anticipating a possible downturn available in the market.

- Rebalancing Portfolios: Wilke could be rebalancing his portfolios by promoting some tokens and shopping for others. This could possibly be primarily based on modifications in market situations, venture developments, or his funding technique.

- Market Hypothesis: Wilke could be speculating on short-term value actions or benefiting from arbitrage alternatives between totally different cryptocurrency exchanges.

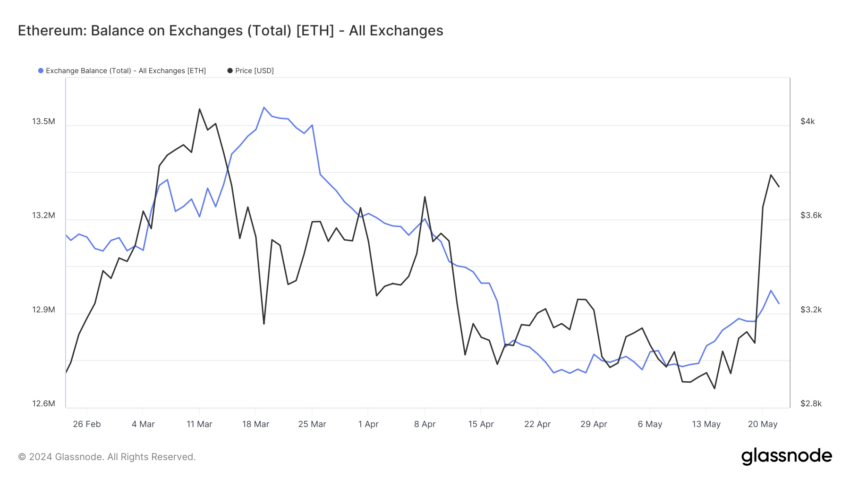

Whether or not Wilke goals to e-book earnings, rebalance his portfolio, or speculate available on the market, he seems not the one one. Ethereum’s stability on exchanges reveals a spike within the tokens obtainable to promote.

- Stability on Exchanges: This refers back to the whole quantity of Ethereum held in cryptocurrency alternate wallets.

Over the past two weeks, greater than 242,000 ETH have moved to cryptocurrency alternate wallets. This means elevated buying and selling exercise on exchanges that may contribute to cost volatility.

Ethereum ETF Approval Looms

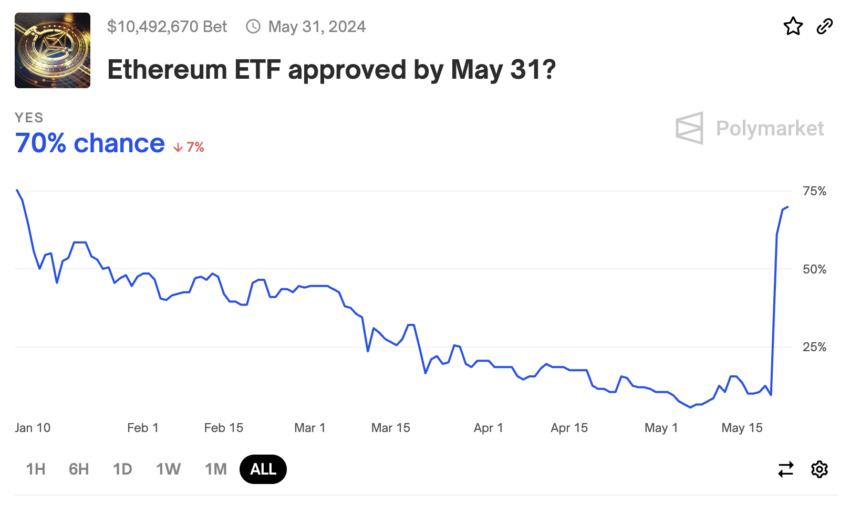

The timing of those transfers is notable, because it aligns with immediately’s SEC closing ruling concerning the Vaneck Ethereum ETF. Curiously, on Could 20, the SEC requested Nasdaq, CBOE, and NYSE to refine their functions for itemizing spot Ethereum ETFs, hinting at a possible approval of those filings.

In response to this regulatory growth, Eric Balchunas and James Seyffart, ETF analysts at Bloomberg Intelligence, remarked that the probability of approval has considerably elevated, shifting from solely 25% to a substantial 75%.

“Hearing chatter this afternoon that the SEC could be doing a 180 on this increasingly political issue, so now everyone is scrambling. But again, we cap it at 75% until we see more, e.g., filing updates,” Balchunas wrote.

Learn extra: Ethereum ETF Defined: What It Is and How It Works

Equally, Polymarket, a decentralized prediction market platform that permits customers to put bets on world occasions, reveals a big improve in approval odds, which have risen from 10% to 70% over the previous 72 hours.

Warning Sign for Merchants

Though business leaders like Anthony Pompliano see the Ethereum ETF approval as an “approval of the entire industry” and as “the last dam to be broken,” merchants have to be cautious. The rising ETH deposits to cryptocurrency alternate wallets trace at the opportunity of a sell-off or a spike in profit-taking.

In the meantime, the Tom DeMark (TD) Sequential indicator presents a promote sign on Ethereum’s every day chart.

- TD Sequential Indicator: It is a technical evaluation instrument used to establish potential market development exhaustion factors and upcoming value reversals.

- Setup Part: This entails counting a collection of 9 consecutive value bars, the place every bar closes larger (for an uptrend) or decrease (for a downtrend) than the bar 4 durations earlier.

- Countdown Part: Following the setup part, a countdown begins the place a collection of 13 extra value bars are counted in the event that they shut decrease (in a downtrend) or larger (in an uptrend) than the shut two bars earlier.

The present inexperienced 9 candlestick on the every day chart suggests {that a} spike in promoting strain may see Ethereum retrace for one to 4 every day candlesticks and even begin a brand new downward countdown part earlier than the uptrend resumes.

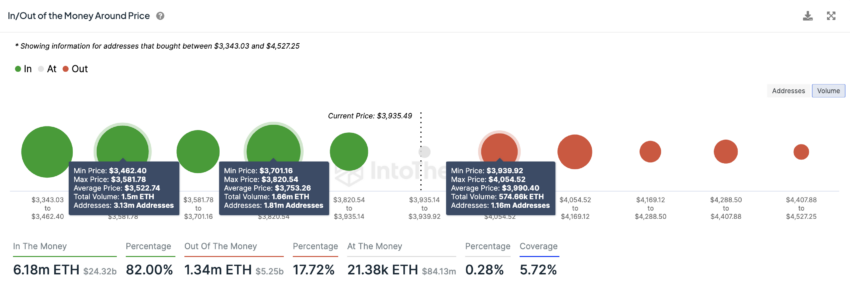

Regardless of the bearish alerts seen from an on-chain and technical perspective, the In/Out of the Cash Round Value (IOMAP) indicator means that Ethereum is above important areas of assist that might maintain within the occasion of a correction.

- IOMAP: This metric helps analyze and visualize the distribution of holders’ positions relative to the present value. It helps perceive the potential assist and resistance ranges primarily based on the variety of addresses holding a selected cryptocurrency at totally different value ranges.

- Within the Cash: Refers to addresses that acquired the cryptocurrency at a value decrease than the present market value, indicating potential assist ranges as holders are prone to promote at a revenue.

- Out of the Cash: Refers to addresses that acquired the cryptocurrency at a value larger than the present market value, indicating potential resistance ranges as holders may need to break even or decrease losses.

Based mostly on the IOMAP, over 1.81 million addresses purchased round 1.66 million ETH between $3,820 and $3,700. This demand zone may preserve Ethereum’s value at bay amid rising promoting strain. But when it fails to carry, the subsequent key space of assist is between $3,580 and $3,462, the place 3.13 million addresses bought over 1.50 million ETH.

Learn extra: Ethereum (ETH) Value Prediction 2024/2025/2030

However, crucial resistance barrier for Ethereum is between $3,940 and $4,054. Right here, over 1.16 million addresses had beforehand bought round 574,660 ETH.

If Ethereum overcomes this hurdle and prints a every day candlestick shut above $4,170, the bearish outlook can be invalidated. This might lead to a brand new upward countdown part towards $5,000.

Abstract and Conclusions

Ethereum co-founder Jeffrey Wilke’s current switch of 10,000 ETH to Kraken is indicative of broader market actions, the place buyers are shifting important quantities of ETH to exchanges. This development aligns with elevated buying and selling exercise, suggesting potential profit-taking, portfolio rebalancing, or market hypothesis amongst Ethereum holders. The stability of ETH on exchanges has spiked, indicating a possible rise in market volatility.

This market motion comes at a important time, because the SEC is about to make a closing ruling on Vaneck’s Ethereum ETF. Analysts have famous a considerable improve within the probability of approval, which has surged from 25% to 75%. Such regulatory developments are seen as a constructive sign for the broader cryptocurrency market, doubtlessly paving the way in which for additional institutional funding.

Learn extra: Tips on how to Purchase Ethereum (ETH) and Every little thing You Must Know

Regardless of technical indicators suggesting a attainable short-term bearish development, the IOMAP indicator reveals robust assist ranges for Ethereum. This implies that whereas there could also be short-term corrections, the underlying demand for Ethereum stays strong. Lengthy-term holders seem assured, persevering with to build up ETH, which bodes nicely for its future value stability and progress.

Disclaimer

In step with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.