Stablecoins have turn out to be an important a part of the blockchain area, providing stability in a extremely risky market. Though there are dozens of stablecoins with totally different collateral accessible to buyers immediately, Tether’s USDT stays the to-go alternative for many crypto customers.

On this article, we discover the significance of stablecoins, specializing in USDT and its unconditional dominance.

The Want for Stability

Stablecoins are digital property designed to take care of a steady worth by being pegged to a reserve asset, such because the US greenback, euro, and even commodities like gold. They obtain this stability via varied mechanisms, together with fiat-collateralized, crypto-collateralized, and algorithmic stablecoins. Fiat-collateralized stablecoins, the most typical kind, again every token issued with reserves of the corresponding fiat foreign money, guaranteeing assist by a real-world asset.

Whereas many crypto buyers take pleasure in a little bit of volatility, the extent seen in most crypto property could make it tough to make use of them for funds or buying and selling. Stablecoins handle this difficulty by providing a steady and dependable different, facilitating their use in a variety of functions, together with base buying and selling pairs, remittances, and decentralized finance (DeFi).

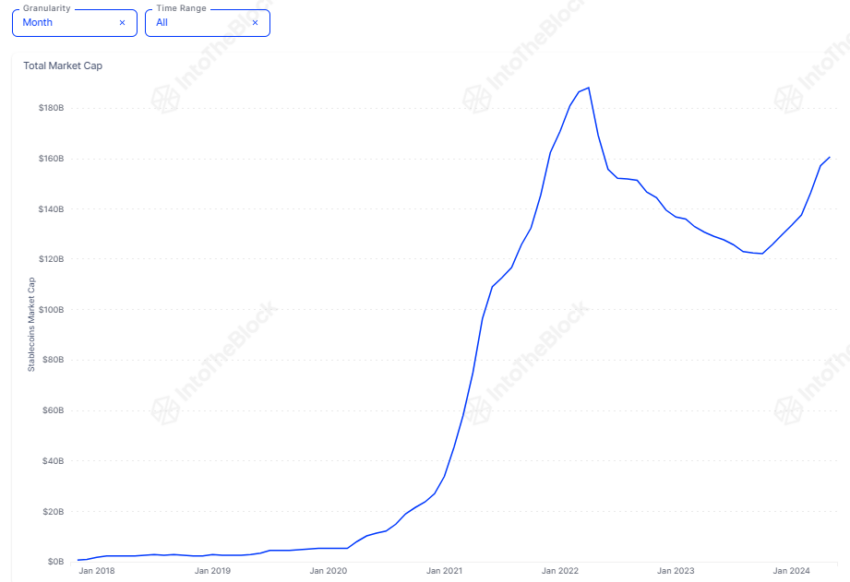

This has resulted in substantial development for stablecoins, now boasting a mixed market capitalization of $161 billion. The chart under highlights this important improve, which started in 2020.

Learn extra: Purchase USDT in Three Straightforward Steps – A Newbie’s Information

“While some of this growth is due to the rising interest in cryptocurrencies, it is primarily driven by the growing importance of DeFi and the crucial role stablecoins play in DeFi primitives like lending protocols and automated market makers (AMMs),” Vincent Maliepaard, Advertising Director at IntoTheBlock, informed BeInCrypto.

USDT: The Undisputed Market Chief

Regardless of sturdy competitors, Tether (USDT) has established itself as a very powerful stablecoin within the cryptocurrency market. Launched in 2014, USDT is pegged to the US greenback, with every token purportedly backed by an equal quantity of fiat foreign money held in reserve.

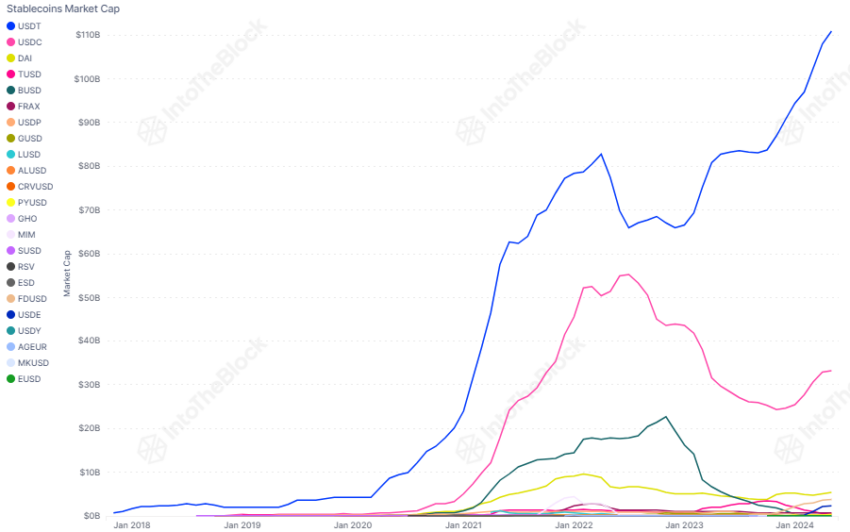

Knowledge from IntoTheBlock exhibits that USDT, with a market cap of $111 billion, accounts for simply over 70% of the whole stablecoin market capitalization. In distinction, the second largest stablecoin, USDC, accounts for simply 21%.

Learn extra: 9 Finest Crypto Wallets to Retailer Tether (USDT)

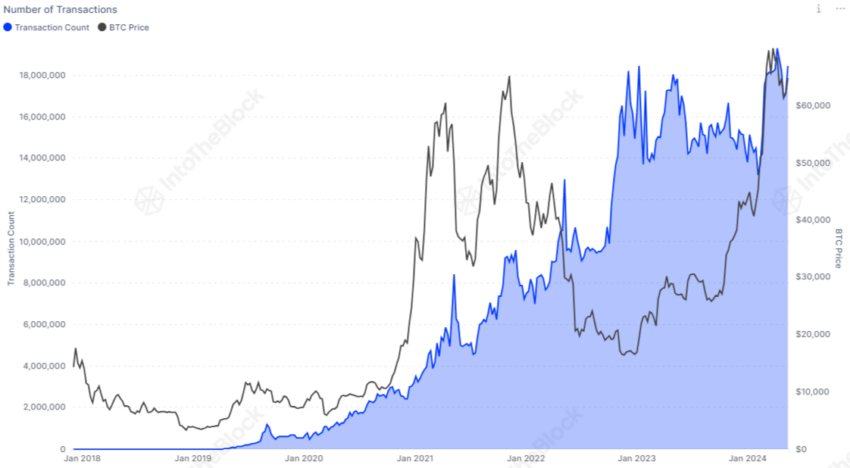

Moreover, there is no such thing as a signal that this development is slowing down quickly. The variety of USDT transactions has considerably elevated because the begin of the yr and is approaching new highs.

Maliepaard notes USDT’s dominance is attributed to a number of components:

- Liquidity and Accessibility: USDT boasts the best buying and selling quantity amongst stablecoins and is accessible on most centralized and decentralized exchanges as a base buying and selling pair.

- Integration with DeFi: Many DeFi protocols and platforms use USDT for transactions, lending, and borrowing, enabling participation with out publicity to cost volatility.

- Cross-Border Transactions: USDT facilitates quick and cost-effective cross-border transactions, providing an environment friendly different to conventional banking techniques.

- Steady Retailer of Worth: In areas experiencing hyperinflation or financial instability, USDT presents a dependable retailer of worth.

Evaluating Utilization of USDT Throughout Totally different Chains

Whereas USDT exercise is booming throughout all chains, not all are created equal. Knowledge means that customers make the most of stablecoins in a different way throughout varied networks. By analyzing their habits on totally different chains, we are able to see how USDT is utilized in numerous methods. Whether or not it’s for buying and selling, transferring worth, or appearing as a steady retailer of worth, USDT’s versatility is clear.

TRON Dominates USDT Transactions

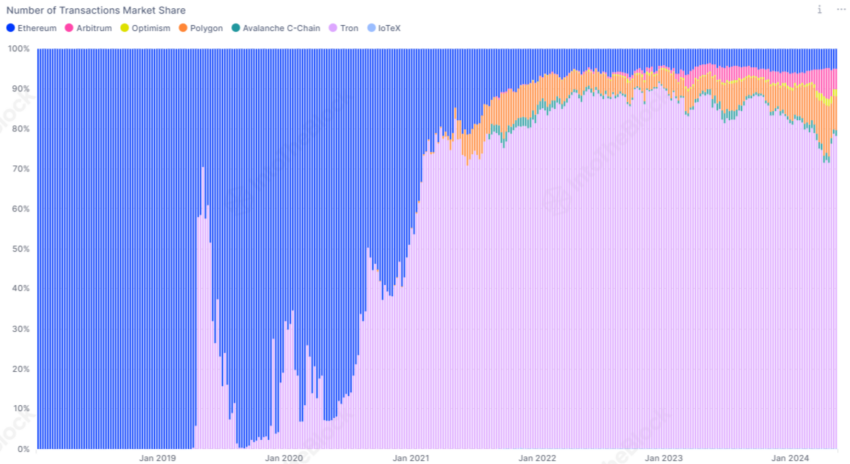

TRON leads in transaction quantity with a dominant 78% share. The chart under highlights its superiority in comparison with different blockchain networks.

This prominence is primarily because of TRON’s low transaction prices and excessive availability for deposits and withdrawals on main centralized exchanges, making it the popular possibility for cross-border Tether’s USDT transactions. Surprisingly, the runner-up isn’t Ethereum however Polygon, which has over 8% of the whole USDT transactions.

Transaction Quantity Comparability

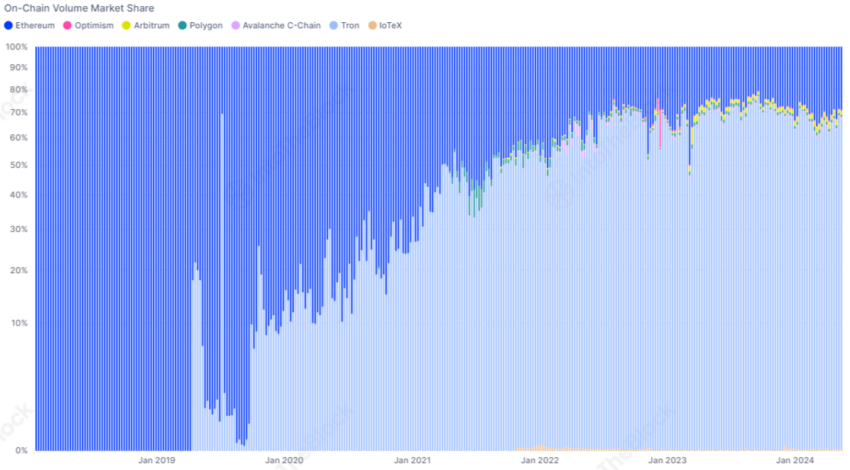

Analyzing the stablecoin’s quantity market share reveals that Ethereum’s transaction quantity far exceeds its variety of transactions, highlighting its position in facilitating higher-value transfers. In distinction, chains like Polygon, Optimism, and Avalanche have the next variety of transactions however contribute much less to the general quantity, indicating their use for smaller, extra frequent transactions.

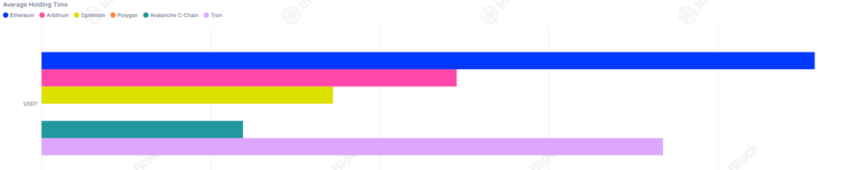

Holding vs. Transacting

The typical holding time of USDT on every chain additional helps this discovering. Knowledge exhibits that Ethereum customers usually hold USDT for 228 days, practically thrice longer than holders on Optimism. TRON addresses additionally keep USDT for an prolonged interval, averaging 183 days.

These insights point out that on Ethereum and TRON, USDT is primarily held to mitigate market volatility, serving as a steady retailer of worth. Conversely, on chains like Optimism and Arbitrum, USDT is continuously used for transactions, possible in DeFi-related functions the place fast entry to liquidity and switch pace are essential.

The Way forward for USDT

Stablecoins, significantly USDT, play an important position within the blockchain trade by offering stability and enhancing the utility of digital property. The current development of USDT throughout varied blockchain networks solidifies its place within the cryptocurrency market. Because the trade widens, the significance of stablecoins will possible develop, pushed by their position in DeFi, buying and selling, and bridging the hole between conventional finance and blockchain.

Disclaimer

In keeping with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.