In a last transfer concluding weeks of auctions, the property of bankrupt crypto alternate FTX has accomplished the sale of $2.6 billion value of deeply discounted Solana tokens.

The public sale noticed distinguished patrons equivalent to Determine Markets and Pantera Capital securing the final of FTX’s discounted belongings.

FTX’s Chapter and Restoration Efforts

Sources accustomed to the matter reveal that Determine Markets acquired a block of 800,000 Solana tokens for roughly $80 million, translating to about $102 per token. This worth is considerably decrease than the market worth of round $166 per token, highlighting the urgency of FTX’s liquidation efforts.

In response to sources accustomed to the matter, Determine Markets acquired a block of 800,000 Solana tokens for roughly $80 million. This interprets to about $102 per token, considerably decrease than the market worth of round $166. This low cost displays the urgency of FTX’s liquidation efforts and the market’s response to the sale. Kyle Chasse, founding father of Grasp Ventures, famous the significance of those offers.

“This development concludes a significant chapter in the liquidation of FTX’s assets,” Chassé mentioned.

Learn extra: FTX Collapse Defined: How Sam Bankman-Fried’s Empire Fell

Pantera Capital additionally participated within the public sale, although particulars about their buy worth stay undisclosed. Regardless of market volatility, firm’s continued curiosity in Solana highlights its strategic funding strategy. Beforehand, it tried to boost $250 million to purchase Solana tokens from FTX, signaling their confidence within the cryptocurrency’s long-term potential. The numerous low cost provided by the bankrupt alternate resulted in a noticeable drop in SOL worth.

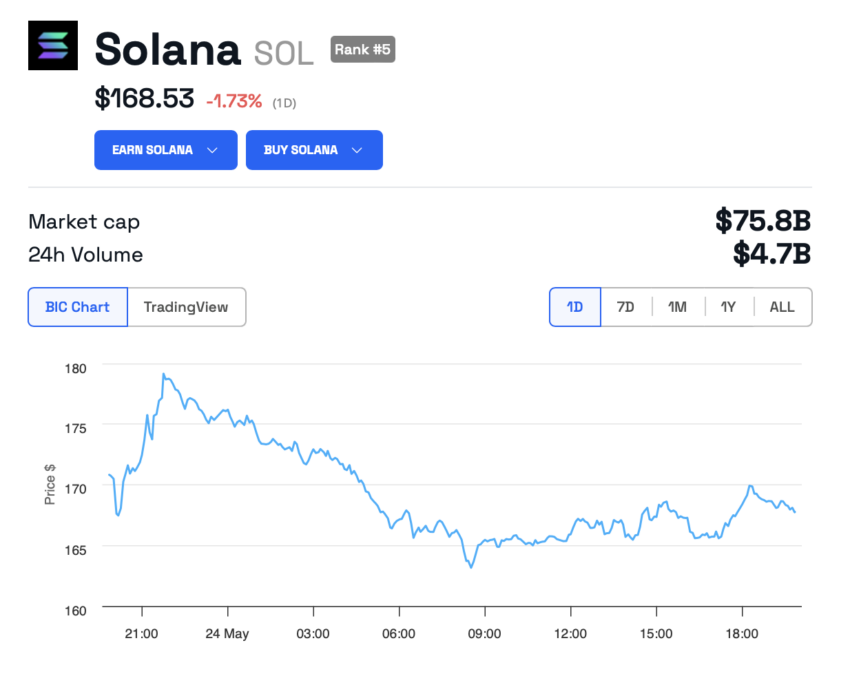

This time, the information didn’t set off a sell-off. In response to BeInCrypto, the asset is buying and selling at $168.5, reflecting a 1.73% loss within the final 24 hours.

Learn extra: Solana (SOL) Value Prediction 2024/2025/2030

FTX’s collapse, triggered by the monetary mismanagement of its founder, Sam Bankman-Fried, has been a high-profile case within the crypto trade. The alternate owes over two million clients and different collectors over $11 billion. Regardless of these liabilities, FTX has revealed a surplus money reserve of $16.3 billion, positioning it to repay its collectors, together with curiosity absolutely.

The alternate’s capacity to uncover a surplus money reserve and its proactive asset liquidation efforts supply a optimistic outlook for its restoration plan. FTX’s revised Chapter 11 plan, awaiting courtroom approval, goals to make sure equitable asset distribution amongst its clients.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.