HONG KONG (Reuters) – Shares of China Evergrande (HK:) New Vitality Automobile Group greater than doubled on Monday as commerce resumed after the corporate mentioned liquidators had agreed on behalf of key shareholders to promote a stake within the electrical automobile (EV) maker.

Shares of embattled developer China Evergrande’s EV unit soared as a lot as 113% to HK$0.81, their highest since September 22, turning into the highest gainer on the Hong Kong bourse, and final stood up 79%, following the Could 17 commerce halt.

The non-binding deal by liquidators appearing for China Evergrande Group, Evergrande Well being Trade and Acelin International offers for a third-party purchaser to take a stake of 29% within the unit, with an choice for 29.5% extra, the EV unit mentioned on Sunday.

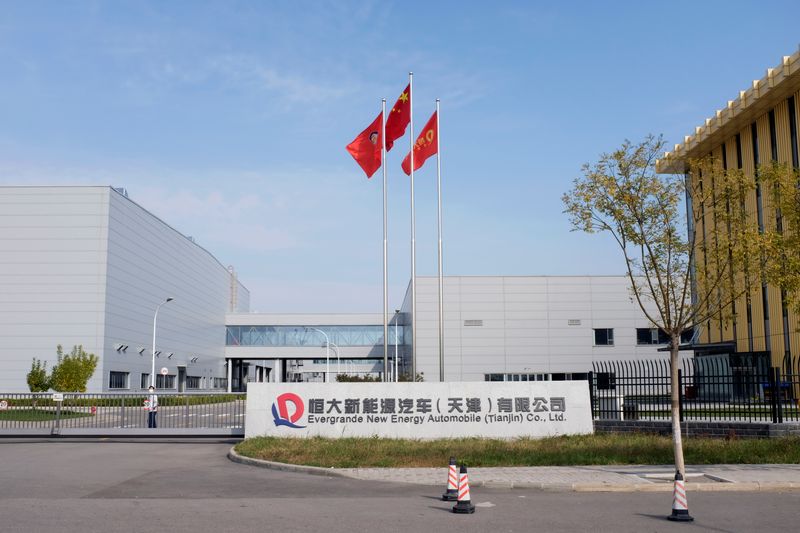

The three collectively maintain 58.5% of the cash-strapped EV unit, whose manufacturing unit within the northern metropolis of Tianjin stopped manufacturing at first of 2024.

The EV unit mentioned the time period sheet additionally talked about that the potential purchaser would offer a line of credit score to fund its operation and enterprise growth.

Final week, China Evergrande New Vitality Automobile mentioned its unit had acquired a letter from native administrative our bodies demanding compensation of 1.9 billion yuan ($262 million) in subsidies and incentives.

Earlier this 12 months, China Evergrande, the world’s most indebted property developer, was ordered to be liquidated after it was unable to supply a concrete restructuring plan, greater than two years after it defaulted on its offshore debt.