The latest improvement of spot Ethereum (ETH) exchange-traded funds (ETFs) by the US Securities and Trade Fee (SEC) has considerably influenced the crypto funding setting.

Following the SEC’s preliminary approval for spot Ethereum ETFs, Bitcoin (BTC) counterparts proceed to report optimistic inflows.

US Spot Crypto ETFs Surge Amid Renewed Optimism

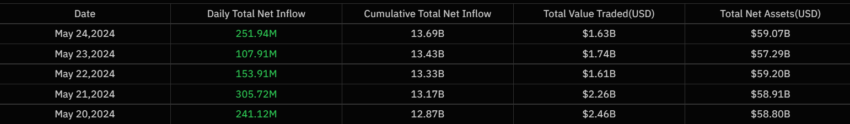

SoSo Worth knowledge reveals that as of Might 24, US spot Bitcoin ETFs had a complete internet influx of $251.94 million. This marks ten consecutive days of inflows. On the identical day, BlackRock’s iShares Bitcoin Belief (IBIT) and Constancy Sensible Origin Bitcoin Fund (FBTC) obtained inflows of $182 million and $44 million, respectively.

In the meantime, Grayscale Bitcoin Belief ETF (GBTC) obtained no flows on the identical day. That is noteworthy contemplating the adverse stream streak for US spot Bitcoin ETFs from late April till early Might.

Learn extra: Crypto ETN vs. Crypto ETF: What Is the Distinction?

Certainly, the spot Ethereum ETFs have infused the crypto market with renewed optimism. BeInCrypto reported that Ethereum and a few tokens in its ecosystem have proven spectacular efficiency since Monday.

Nonetheless, you will need to observe that the spot Ethereum ETFs have but to be formally launched, and SEC approval for the S-1 filings is awaiting. James Seyffart, an ETF analyst at Bloomberg Intelligence, expects that the spot Ethereum ETFs will ” take a few weeks however may take longer” to commerce out there.

“Typically, this process takes months. Like up to 5 months in some examples, but Eric Balchunas and I think this will be at least somewhat accelerated. Bitcoin ETFs were at least 90 days. Will know more soon,” he defined.

Nonetheless, consultants stay optimistic. One other ETF analyst, Eric Balchunas, predicts that spot Ethereum ETFs may purchase “10% to 15% of the assets of the spot Bitcoin ETFs.”

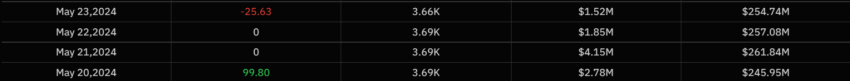

Regardless of renewed curiosity within the US market, spot crypto ETFs in Hong Kong noticed a comparatively muted efficiency. Information exhibits that from Might 20 to Might 23, Hong Kong’s spot Bitcoin ETFs recorded no flows for 2 consecutive days. In the meantime, their Ethereum counterparts solely recorded an influx of 62.80 ETH on Might 22.

Learn extra: Why do Hong Kong Spot Crypto ETFs Matter?

Nonetheless, a latest report talked about that Hong Kong’s regulator is contemplating together with staking for spot Ethereum ETFs. That is notably fascinating since potential issuers within the US have eliminated staking from their filings. By together with staking rewards, Hong Kong’s spot Ethereum ETFs may present a aggressive edge, providing further yield for buyers.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.