The latest approval of spot Ethereum (ETH) exchange-traded funds (ETFs) by the US Securities and Alternate Fee (SEC) has stirred the crypto market. ETH and different altcoins in its ecosystem witnessed a renewed curiosity, with their costs growing considerably.

Analysts at crypto analysis agency Kaiko shared their ideas concerning the SEC’s preliminary approval. They see the SEC’s nod as a big shift in how ETH is perceived and controlled, with implications for its future efficiency and market dynamics.

Anticipated Market Actions and Investor Reactions

Will Cai, Head of Indices at Kaiko, famous that the SEC’s request to take away staking points from spot Ethereum ETFs “implicitly” classifies ETH as a commodity. Cai sees this transfer may have broad regulatory implications for related tokens with staking mechanisms within the US.

“With these approvals, the SEC implicitly stated that ETH (without staking) is a commodity rather than a security. This isn’t just about access to ETH, but has significant and likely positive ramifications on how all similar tokens will be regulated in the U.S. with respect to trading, custody, transfer, etc,” Cai mentioned.

Learn extra: Ethereum ETF Defined: What It Is and How It Works

Cai’s perception aligns with these of different trade specialists who view this improvement as a pivotal second for the crypto trade. Daniel Serb, Vice President of Enterprise Growth at MultiversX, emphasised the constructive implications for crypto and mainstream buyers. He notes the potential for elevated adoption and the necessity for strong blockchain infrastructure to deal with this progress.

“Despite questions around control of crypto assets emerging, we see this ruling lifting all boats and boosting the next wave of adoption. While it’s a matter of excitement for the industry, proponents of crypto would do well to ensure the ecosystem can handle increased compute demand while maintaining security and decentralization,” Serb instructed BeInCrypto.

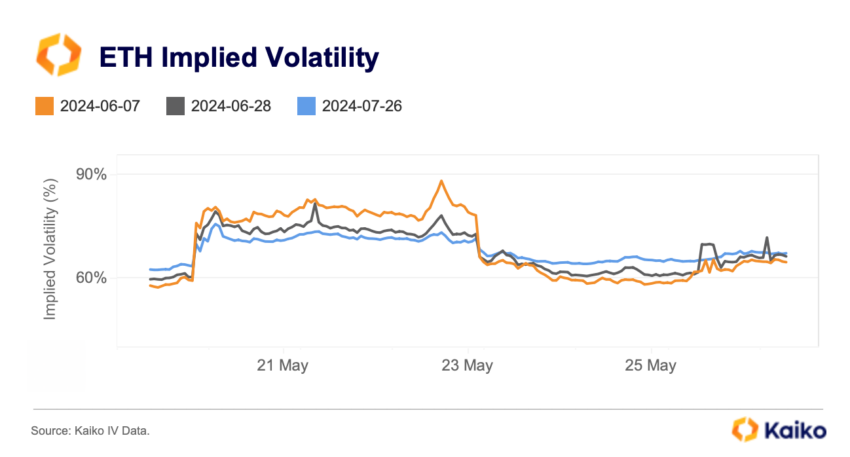

Moreover, Kaiko’s evaluation examines Ethereum’s implied volatility surge. This situation signifies market stress earlier than stabilizing. Derivatives markets additionally mirrored this shift in sentiment, with Ethereum perpetual futures funding charges hitting multi-month highs and open curiosity reaching a report $11 billion.

Regardless of these constructive alerts, Kaiko analysts count on potential promoting strain on ETH as a result of doubtless outflows from Grayscale Ethereum Belief (ETHE), which has just lately traded at a reduction between 6% and 26%. As the most important ETH funding automobile with over $11 billion in belongings, ETHE would possibly face significant redemptions much like these seen with Grayscale Bitcoin Belief (GBTC) following the launch of spot Bitcoin ETFs.

“Should we see a similar magnitude of outflows from ETHE, this would amount to $110 million of average daily outflows or 30% of ETH’s average daily volume on Coinbase,” they wrote.

Learn extra: How you can Spend money on Ethereum ETFs?

However, the approval of spot Ethereum ETFs signifies a serious milestone with far-reaching implications for the broader crypto market. Whereas potential outflows from Grayscale’s ETHE pose short-term challenges, the long-term outlook for Ethereum and associated tokens stays constructive as regulatory readability and market dynamics evolve.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.