The present on-chain dynamics for Bitcoin are establishing a doubtlessly bullish state of affairs.

Following final week’s insights, Bitcoin has proven energy, presently buying and selling between $67,500 and $70,000 USD. Traders eagerly anticipate persevering with this upward development to succeed in a brand new all-time excessive. Let’s discover why this may occur.

This lower in sell-side strain, mixed with modest however constant capital inflows, means that the market is getting ready for a big upward transfer.

Bitcoin Technical Outlook

Bitcoin’s value has discovered assist on the purple descending trendline, indicating profit-taking. The worth seems poised to check the every day Ichimoku cloud, which might be a serious assist degree.

If the worth breaks under the cloud, sentiment might shift to impartial, doubtlessly inflicting Bitcoin’s value to development towards $64,000 (Crimson Tenkan Line).

Let’s Look at Some Key Bitcoin On-Chain Metrics

Throughout Bitcoin bull markets, long-term holders normally promote a few of their holdings as costs improve.

This sample was evident from early 2024 to April, with vital declines within the provide final energetic for greater than 1-year and 2-year cohorts. Nonetheless, the provision held in UTXOs (unspent transaction outputs) for over 3 years continues to rise. Indicating a long-term bullish sentiment.

Greater than half of the overall BTC provide hasn’t moved on-chain in over one yr, reflecting sturdy holder conviction.

Learn Extra: How To Get Paid in Bitcoin (BTC): Every little thing You Want To Know

With the worth recovering from the $56,000 correction, we are able to observe that these cohorts have halted the distribution of Bitcoins. Each the 1-year+ and 2-year+ cohorts have ceased promoting, indicating a shift in the direction of holding reasonably than distributing their BTC.

Understanding Bitcoin’s On-chain Assist and Resistance Ranges with the URPD

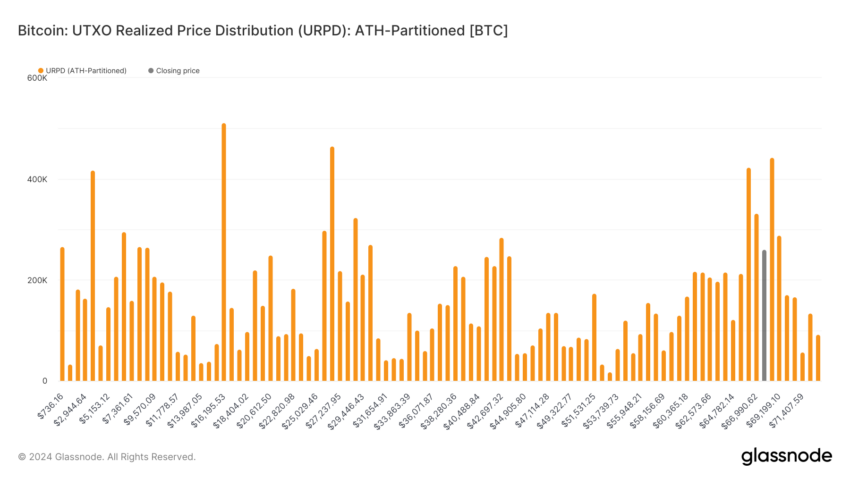

The URPD (Unspent Realized Value Distribution) metric offers worthwhile insights into the place Bitcoin is held at varied value ranges. Consider it as a map that reveals the costs at which most individuals have purchased their BTC.

A good portion of Bitcoin is held at costs throughout the present buying and selling vary of $67,500 to $70,000 USD. Particularly, 6% of Bitcoin’s complete provide is held on this value vary. This focus of holdings signifies that many consumers bought BTC at these costs.

These holders will possible keep their positions reasonably than promote shortly, creating a strong assist degree that helps stop sharp value declines.

Only one.1% of Bitcoin’s complete provide exceeds the $70,000 value degree. This small share suggests that only a few folks purchased BTC at costs increased than at this time’s value. Consequently, there aren’t many sellers trying to promote their Bitcoin for a fast revenue, as they might both be at a loss or break-even level.

This lack of promoting strain above the present value creates a good atmosphere for potential upward motion, as there may be much less resistance from profit-taking.

Learn extra: Bitcoin Value Prediction 2024/2025/2030

Strategic Suggestions

This setup is sweet information for Bitcoin as a result of it suggests two issues:

Sturdy Assist: The massive quantity of Bitcoin held slightly below the present value acts like a security internet. If the worth drops a bit, many consumers will possible step in and purchase extra, stopping the worth from falling an excessive amount of.

Room for Development: With little or no Bitcoin held above the present value, there aren’t many holders trying to promote shortly. Which means if extra entities begin shopping for Bitcoin, the worth can rise shortly to $73,000 as a result of there isn’t a lot resistance from sellers.

Regardless of the bullish indicators, traders also needs to be ready for a possible value reversal. If Bitcoin breaks under the every day Ichimoku cloud, sentiment might shift to impartial, and the worth may development in the direction of $64,000.

It’s important to have a danger administration technique in place to deal with such situations, together with setting stop-loss orders and being prepared to regulate positions accordingly.

Disclaimer

In step with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.