Bitcoin’s present market habits is drawing notable comparisons to the 2015-2017 bull market, capturing the eye of buyers.

With historic parallels drawing optimistic projections, the outlook for Bitcoin stays promising because it mirrors patterns from its formative bull market years.

Bitcoin Buyers Proceed to Accumulate

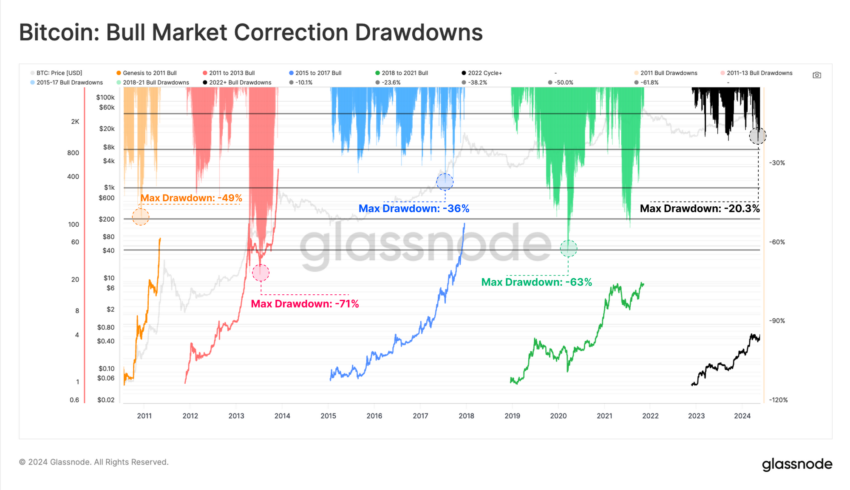

Bitcoin recorded a correction of over 20% after hitting an all-time excessive of almost $74,000 in March 2024. That is the sharpest market correction on a closing foundation for the reason that FTX collapse in November 2024.

Nevertheless, Bitcoin has virtually recovered from this drawdown, hitting $72,000 on Might 21. As of writing, it’s buying and selling at round $69,000.

“From a comparative point of view, the drawdowns pattern across the 2023-24 uptrend appears to be remarkably similar to the 2015-17 bull market,” on-chain evaluation platform Glassnode defined.

Learn extra: Bitcoin (BTC) Worth Prediction 2024/2025/2030

At the moment, Bitcoin lacked by-product devices, and the market was primarily pushed by elementary spot transactions. The introduction and inflows into US spot Bitcoin exchange-traded funds (ETFs) have strengthened a robust market basis much like earlier occasions.

The comparability good points significance contemplating the previous. In its early days, Bitcoin’s market infrastructure was underdeveloped, emphasizing natural development pushed by core demand moderately than speculative buying and selling. At this time’s reliance on spot transactions suggests a return to those primary dynamics, probably signaling a extra sustainable development trajectory.

Previously week, ETF inflows soared to a median of $210 million per day. This dramatic change highlights a robust re-accumulation section, in stark distinction to the promoting pressures exerted by Bitcoin mining, which imposes a every day promote stress of about $32 million as a result of halving occasion.

Though latest weeks have seen a slight slowdown in ETF inflows, the general development stays constructive. In line with information from Farside buyers, ETFs have seen a web influx of $122.1 million thus far this week. This ongoing inflow of capital signifies strong buy-side demand that helps the Bitcoin market.

On-chain evaluation by Santiment additional helps this development, exhibiting that Bitcoin wallets holding a minimum of 10 BTC have elevated their holdings by 154,560 BTC over the previous 5 months. This sample of accumulation amongst bigger pockets holders is a crucial indicator of market sentiment, sometimes related to bullish phases.

Learn extra: Who Owns the Most Bitcoin in 2024?

“Historically, one of crypto’s top leading indicators is the collective holdings of wallets with at least 10 Bitcoin (exchanges or otherwise). When they accumulate, cryptocurrencies rise. When they dump, extended bear markets come,” Santiment defined.

Disclaimer

Consistent with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.