- The Uniswap Basis introduced a delay to an improve vote on the protocol’s price mechanism.

- UNI value reacted decrease, declining 9% to hit lows of $10.17.

The Uniswap Basis has postponed the governance vote on a proposal geared toward activating a brand new price mechanism for the protocol. This proposal would have initiated a price swap for Uniswap, offering for rewards to UNI token holders who stake and delegate their tokens.

Because the market reacted to the information, the value of UNI fell by practically 9% to the touch lows of $10.17 throughout main exchanges.

Uniswap postpones key improve vote

Uniswap introduced the price swap proposal final week, with an on-chain deployment and vote set for as we speak, Friday. Nonetheless, it will no longer go forward as deliberate as per a brand new replace.

In an replace as we speak, the Uniswap Basis said that the delay pertains to a problem a stakeholder raised following the proposal. This has necessitated “additional diligence” on the a part of the Basis.

“Due to the immutable nature and sensitivity of our proposed upgrade, we have made the difficult decision to postpone posting this vote. This was unexpected, and we apologize for the postponement. We will keep the community apprised of any material changes and will update you all once we feel more certain about future timeframes,” the Uniswap Basis famous by way of its official X account.

UNI value

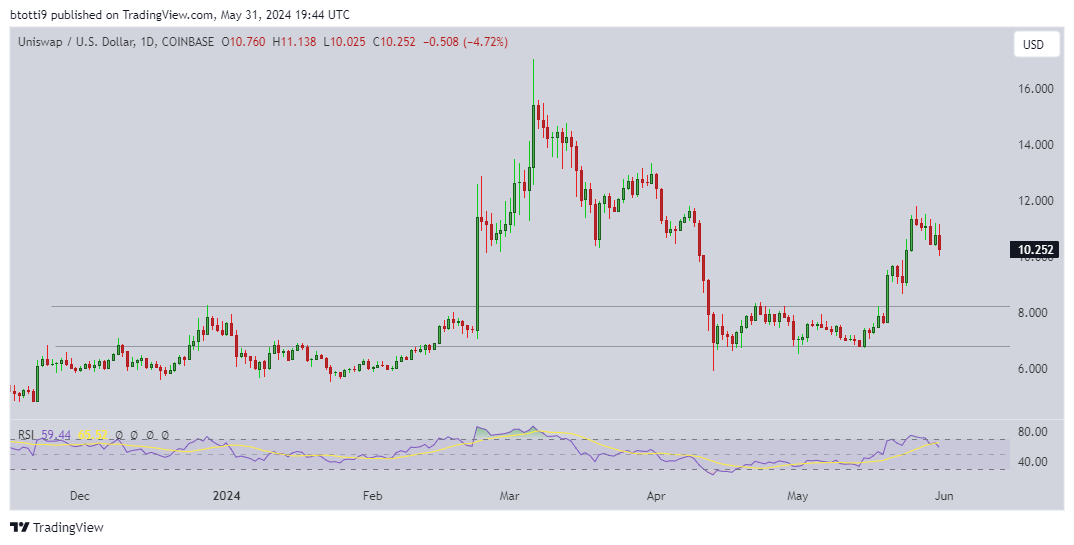

The UNI token traded to highs of $11.04 on Friday earlier than the announcement noticed the token’s worth tumble.

UNI value has moved decrease since hitting highs of $11.79 on Could 26. The RSI on the each day chart suggests bears would possibly but goal costs across the $10 degree.

With Unswap value at present altering arms round $10.26, a breakdown under the psychological degree may push it to assist close to $8.00.

As will be seen within the chart above, UNI value fluctuated inside the $6.80-$8.22 vary for a number of days earlier than the breakout on Could 20.