Polkadot (DOT), a pioneering layer-0 blockchain, is making important strides in tokenizing real-world belongings (RWA).

Amid the rising buzz surrounding RWA tokenization, business consultants imagine Polkadot has the potential to be a market chief. A number of initiatives in its ecosystem additionally help this view.

Key Insights into Polkadot’s Function in Actual-World Asset Tokenization

Polkadot’s structure, designed for interoperability and scalability, is preferrred for tokenizing belongings like actual property, commodities, and mental property. The JAM Whitepaper (Polkadot 2.0) may additional solidify Polkadot’s place within the RWA tokenization market. This initiative bridges conventional finance with the crypto financial system, offering a compliant, safe, and scalable resolution for asset tokenization.

Crypto analyst Michaël van de Poppe lately mentioned Polkadot’s influence on the sector. He highlighted Polkadot’s Software program Improvement Package (SDK) as a extremely widespread instrument within the crypto ecosystem.

Learn extra: RWA Tokenization: A Take a look at Safety and Belief

The SDK permits builders to construct initiatives with minimal funding in blockchain know-how. Consequently, this ease of use facilitates RWA integration into the Polkadot community, utilizing the SDK to ascertain a robust framework for asset tokenization.

“In the meantime, Polkadot has been providing some interesting RWA integrations, as the SDK has been used for those,” he famous.

Polkadot’s ecosystem consists of a number of noteworthy initiatives targeted on RWA tokenization. Power Net, as an illustration, tokenizes inexperienced and renewable power belongings. The mission goals to speed up the power transition by deploying open-source Web3 applied sciences and integrating distributed power assets into the grid.

One standout mission in Polkadot’s RWA ecosystem is Xcavate, which democratizes actual property funding and makes it extra accessible to a broader viewers. Utilizing the Polkadot SDK, Xcavate automates token transfers and mitigates counterparty dangers. Moreover, the mission ensures world entry to early-stage actual property investments with low entry limitations.

One other important mission is the layer-1 (L1) software chain Phyken Community. Phyken focuses on bringing inexperienced and renewable power belongings on-chain, fractionalizing them, and making them accessible to tens of millions of traders. The mission employs a novel know-your-customer (KYC) mechanism utilizing decentralized identities and institutional-grade verifiable credentials to make sure asset authenticity and possession.

Moreover, Centrifuge, some of the widespread RWA tokenization initiatives throughout the Polkadot ecosystem, ranks seventh in market capitalization amongst comparable initiatives. Centrifuge offers liquidity to small and medium-sized enterprises (SMEs) by enabling them to tokenize real-world belongings like invoices, which can be utilized as collateral for financing.

Trade Insights and Future Prospects

Actual-world asset tokenization entails changing tangible and intangible belongings into digital tokens tradable on a blockchain. This course of simplifies transactions, provides liquidity to historically illiquid belongings, and ensures transparency and safety. Subsequently, business consultants imagine tokenizing real-world belongings is essential for the mass adoption of blockchain know-how.

Larry Fink, CEO of BlackRock, has emphasised the potential of tokenization to revolutionize monetary devices. He envisions a future the place each inventory and bond has a singular identifier on a blockchain. This could permit for custom-made funding methods and instantaneous settlements.

Jenny Johnson, CEO of Franklin Templeton, additionally highlighted the transformative potential of tokenizing real-world belongings. She cited examples reminiscent of Rihanna’s NFT royalties and loyalty applications at St. Regis in Aspen.

These examples exhibit the know-how’s means to decrease entry factors and operational prices. In addition they make skilled asset administration extra accessible to youthful traders.

Learn extra: What’s Tokenization on Blockchain?

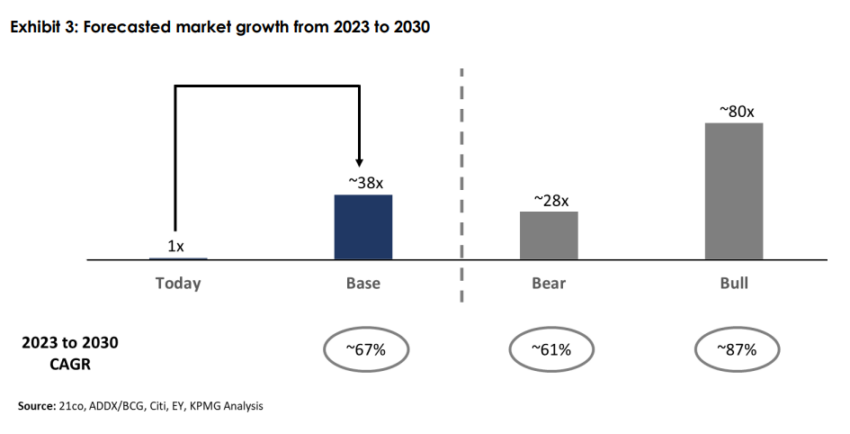

In keeping with a report by KPMG, the potential to tokenize world illiquid belongings is a multi-trillion-dollar alternative. The market is predicted to develop considerably by 2030, with forecasts suggesting a rise from the 2023 baseline by not less than 28 to 80 occasions. Increasing adoption and optimistic regulatory discussions may even additional drive this development.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.