That’s the music I used to be fascinated by once I noticed the headline within the WSJ, Trump Allies Draw Up Plans to Blunt Fed Independence:

A number of individuals who have spoken with Trump in regards to the Fed stated he seems to need somebody accountable for the establishment who will, in impact, deal with the president as an ex officio member of the central financial institution’s rate-setting committee. Underneath such an strategy, the chair would frequently search Trump’s views on interest-rate coverage after which negotiate with the committee to steer coverage on the president’s behalf. A number of the former president’s advisers have mentioned requiring that candidates for Fed chair privately conform to seek the advice of informally with Trump on the central financial institution’s selections, the folks acquainted with the matter stated. Others have made the case that Trump himself might sit on the Fed’s board of governors on an performing foundation, an choice that a number of folks near the previous president described as far-fetched.

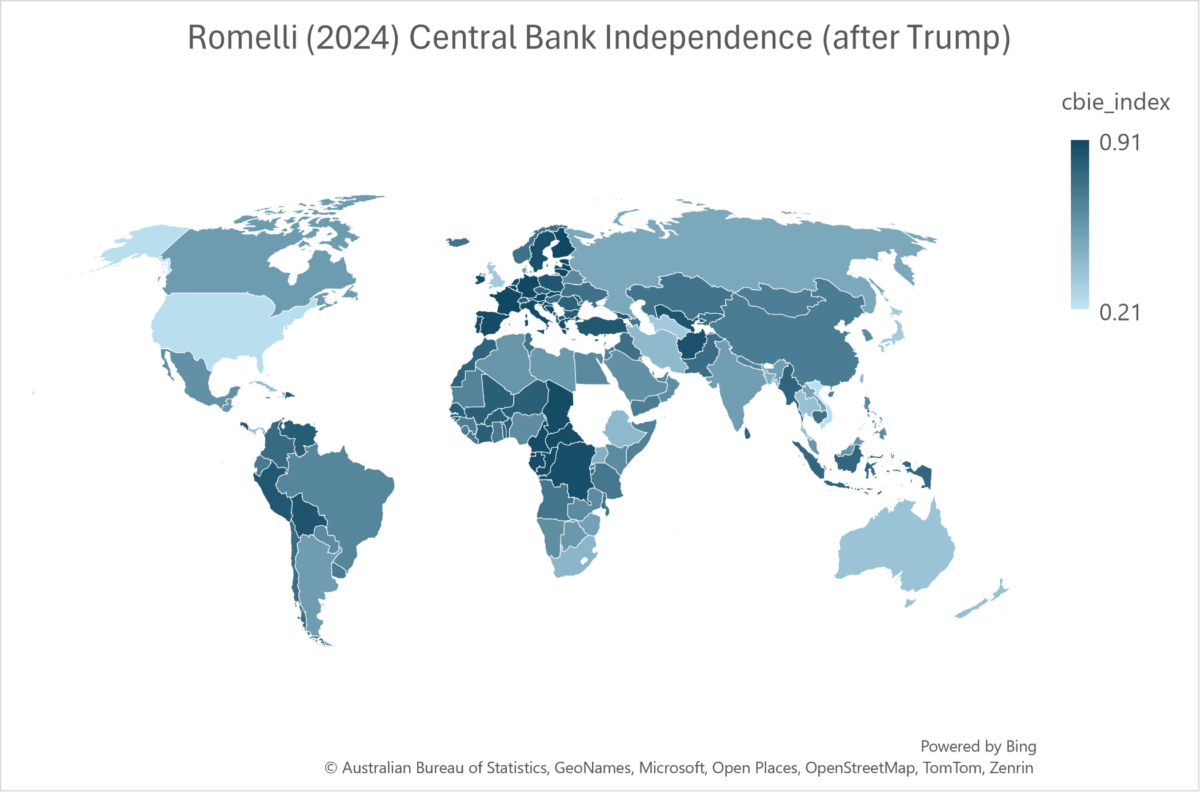

Then, we wouldn’t have to fret about r*, potential GDP, PCE vs. CPI, and so forth. Simply push these rates of interest to zero (if Trump is president; as excessive as potential if he’s not- easy algorithm!) No want for the Fed to rent costly economists. We simply want, say, Larry Kudlow or Steven Moore as Fed Governors. And, extra importantly, we wouldn’t have to waste treasured time making an attempt to estimate the diploma of Fed independence. As an example, right here’s a map of central ban independence (CBPI) in 2024, in keeping with Romelli (2024).

Supply: Romelli (2024). Larger values (darker blue) point out better central financial institution independence.

However with Trump carried out reforms, we might be like…Vietnam!

Supply: Romelli (2024), with US CBI set to Vietnam worth. Larger values (darker blue) point out better central financial institution independence.

Carola Binder’s Central Financial institution Strain Index (mentioned on this publish)signifies that there was stress exerted on the Fed to loosen financial coverage in 2018Q4 (the info extends as much as 2019Q1, so we don’t know what Mr. Trump did in 2019Q2-This fall). Mr. Trump in a second time period, nicely, it’ll be simple for us to determine what the Fed can be doing…