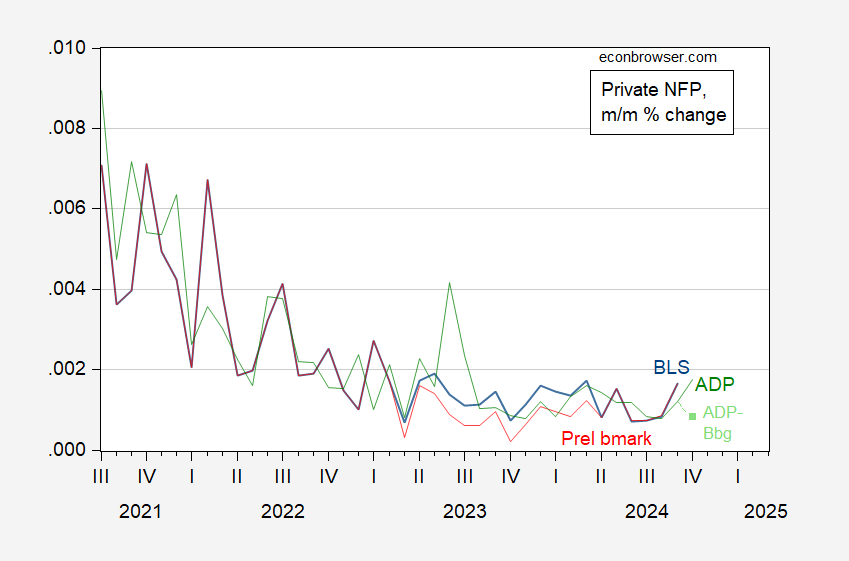

GDP underneath Bloomberg consensus of three.0% at 2.8% (GDPNow nails it). ADP non-public NFP change at 233K vs. Bloomberg consensus at 110K.

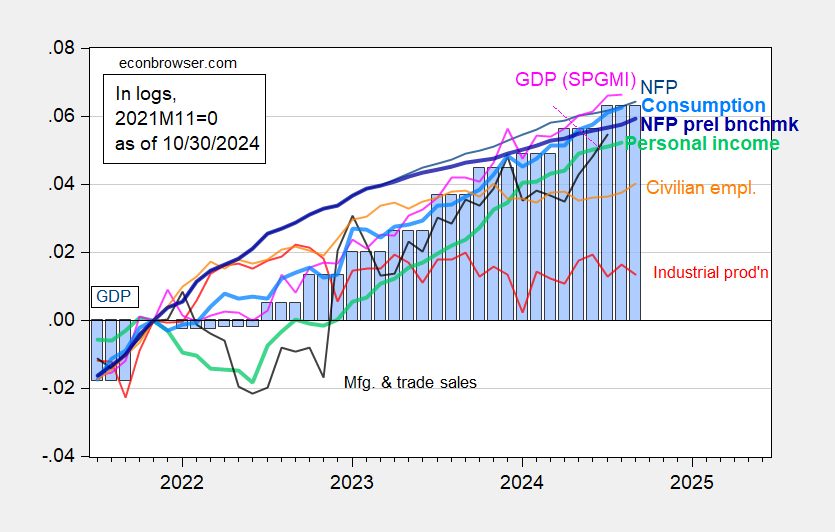

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (daring blue), civilian employment (orange), industrial manufacturing (purple), private revenue excluding present transfers in Ch.2017$ (daring gentle inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q3 1st launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (10/1/2024 launch), and creator’s calculations.

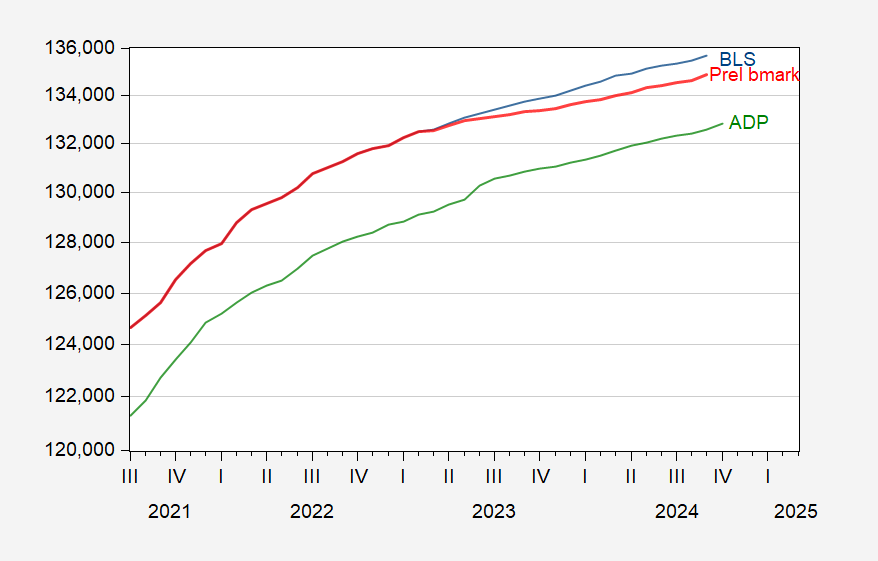

Determine 2: Non-public nonfarm payroll employment from BLS (blue), implied preliminary benchmark revision of personal NFP from BLS (purple), and ADP-Stanford Digital Financial system Lab non-public nonfarm payroll employment (inexperienced), all in 000’s. Supply: BLS, ADP through FRED, and creator’s calculations.

Recall, the ADP numbers will not be primarily based on a survey (so no points in regards to the agency birth-death mannequin output, and so forth.).

Determine 3: Month-on-Month progress price of Non-public nonfarm payroll employment from BLS (blue), implied preliminary benchmark revision of personal NFP from BLS (purple), and ADP-Stanford Digital Financial system Lab non-public nonfarm payroll employment (inexperienced), and Bloomberg consensus (gentle inexperienced sq.), all calculated utilizing log variations. Supply: BLS, ADP through FRED, Bloomberg, and creator’s calculations.

Contra EJ Antoni, Kevin Hassett, Larry Kudlow, Peter Thiel, and Wilbur Ross these don’t appear like recession numbers to me. Nonetheless, we get private revenue and consumption for September tomorrow, in addition to manufacturing and commerce industries gross sales for August.