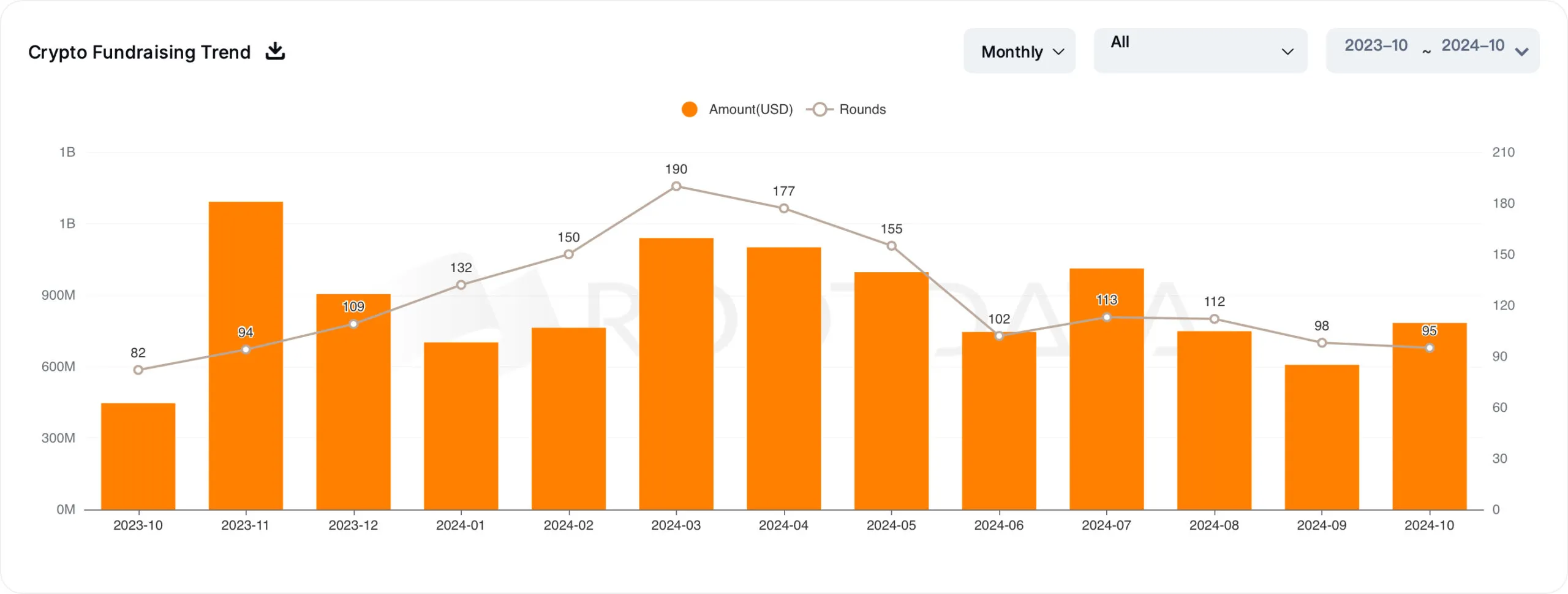

In accordance with RootData statistics, 95 publicly disclosed crypto VC investments occurred in October, representing a 3.06percentdecrease from September’s 98 rounds.

October’s whole fundraising quantity reached $782 million, a 28.84% enhance in comparison with the $607 million raised in September.

Notable Improve in Crypto VC Investments

Enterprise capital exercise acts as a vital barometer of main traders’ curiosity and confidence within the crypto market. Though October noticed the bottom variety of publicly disclosed crypto VC rounds in 2024, with solely 95 offers, investor dedication remained robust.

Regardless of fewer rounds, the entire funds raised surged, reaching $782 million — a big enhance from the $607 million raised in September. The rise in funding quantity highlights an optimistic outlook amongst traders, even amid financial and political shifts.

Learn extra: Greatest Funding Apps in 2024

Apparently, the allocation of funds throughout sectors has shifted considerably. In September, infrastructure and DeFi tasks captured over half of the entire funding worth.

In October, the infrastructure sector led with $249 million raised, whereas gaming, DeFi, and CeFi adopted with $92.5 million, $88.8 million, and $70.18 million, respectively.

Blockstream’s $210 Million Spherical Steals the Highlight

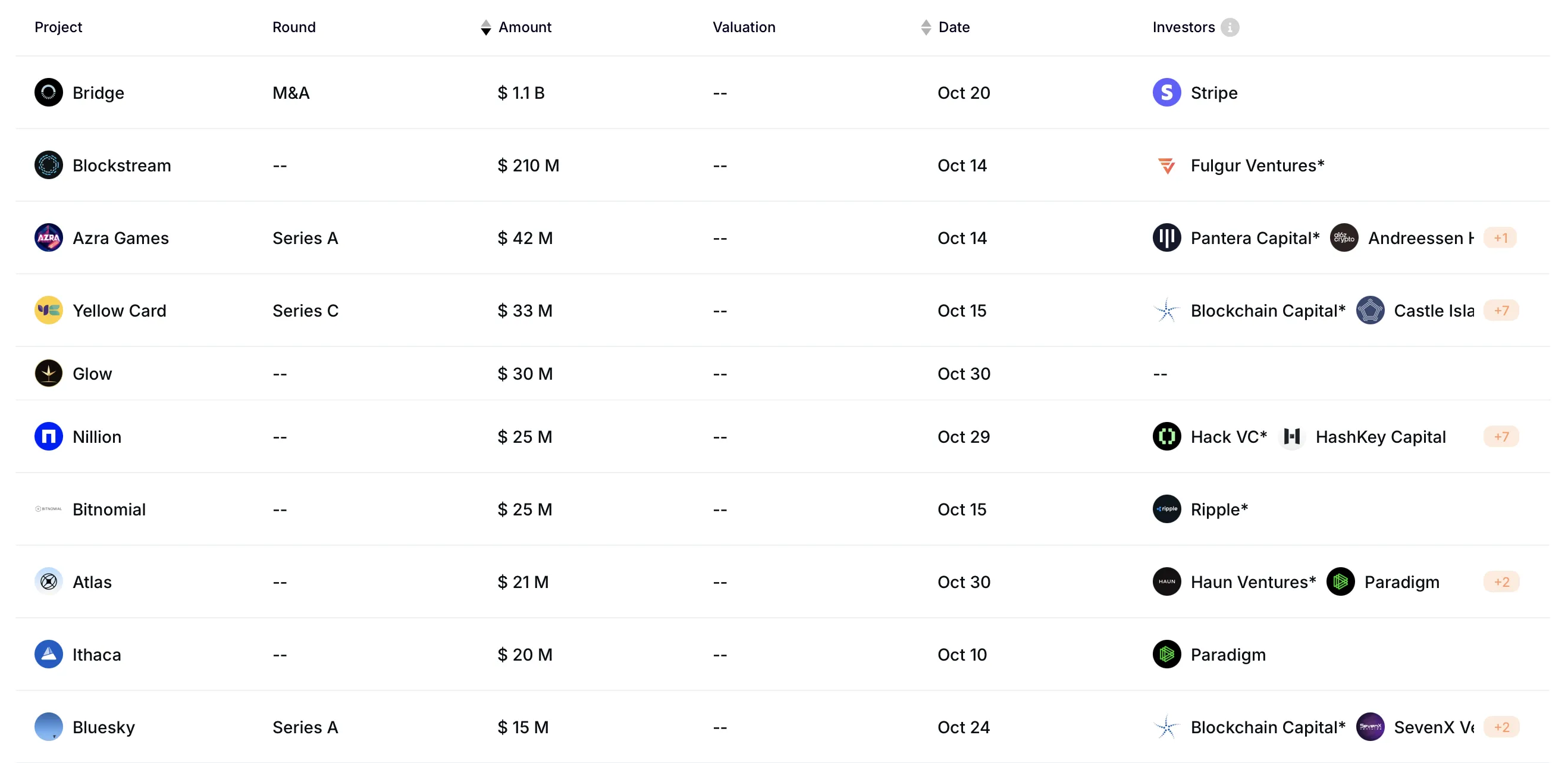

October’s largest funding occasion was Blockstream’s $210 million spherical, led by funding agency Fulgur Ventures. The funds will help the adoption and growth of Blockstream’s Layer-2 applied sciences and growth of its mining operations.

Azra Video games raised $42 million from Pantera Capital, with contributions from A16z Crypto, A16z Video games, and NFX, to speed up the event of its cellular role-playing recreation, Challenge Legends.

Learn extra: High Blockchain Corporations in 2024

Yellow Card, a South African centralized trade and the most important licensed stablecoin on/off-ramp in Africa, secured $33 million in a Collection C spherical led by Blockchain Capital. This newest funding brings Yellow Card’s whole fairness financing to $85 million, supporting its growth in digital monetary companies throughout the continent.

“This fundraise not only demonstrates our resilience, but also highlights the vital role of digital assets for businesses across Africa. We are excited about the opportunities, partnerships, and journey ahead; and I’m proud to work with an incredible cohort of investors that share our vision for the industry and the continent,” mentioned Chris Maurice, CEO and co-founder of Yellow Card.

Glow and Nillion rounded out the highest 5 largest funding rounds of October. Glow, a decentralized bodily infrastructure community (DePIN) of photo voltaic farms throughout the US and India, secured $30 million from Framework and Union Sq. Ventures. The platform incentivizes photo voltaic farms to outperform conventional power grids by way of an financial system primarily based on subsidies and token rewards.

In the meantime, privacy-focused blockchain undertaking Nillion raised $25 million in a spherical led by Hack VC, bringing its whole funding to over $50 million. Nillion operates on the intersection of blockchain and synthetic intelligence, specializing in safe knowledge sharing and storage. Key companions in its ecosystem embrace NEAR, Aptos, Arbitrum, ZKPASS, and Ritual.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.