by Calculated Threat on 5/03/2024 12:24:00 PM

Right this moment, within the Calculated Threat Actual Property Publication: Inflation Adjusted Home Costs 2.4% Under Peak

Excerpt:

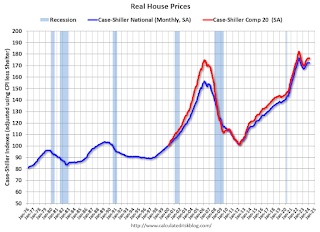

It has been over 17 years because the bubble peak. Within the February Case-Shiller home value index launched on Tuesday, the seasonally adjusted Nationwide Index (SA), was reported as being 71% above the bubble peak in 2006. Nevertheless, in actual phrases, the Nationwide index (SA) is about 10% above the bubble peak (and traditionally there was an upward slope to actual home costs). The composite 20, in actual phrases, is 1% above the bubble peak.

Individuals often graph nominal home costs, however it’s also necessary to have a look at costs in actual phrases. For instance, if a home value was $300,000 in January 2010, the value could be $429,000 right now adjusted for inflation (43% enhance). That’s the reason the second graph under is necessary – this reveals “real” costs.

The third graph reveals the price-to-rent ratio, and the fourth graph is the affordability index. The final graph reveals the 5-year actual return based mostly on the Case-Shiller Nationwide Index

…

The second graph reveals the identical two indexes in actual phrases (adjusted for inflation utilizing CPI).In actual phrases (utilizing CPI), the Nationwide index is 2.4% under the latest peak, and the Composite 20 index is 3.1% under the latest peak in 2022. Each indexes have been largely flat in February in actual phrases.

In actual phrases, nationwide home costs are 10.2% above the bubble peak ranges. There’s an upward slope to actual home costs, and it has been over 17 years because the earlier peak, however actual costs are traditionally excessive.