Within the Fed’s current examination of the differential restoration within the US as in comparison with the Euro space, UK and Canada, I used to be stunned that immigration didn’t make a much bigger look, given my views.

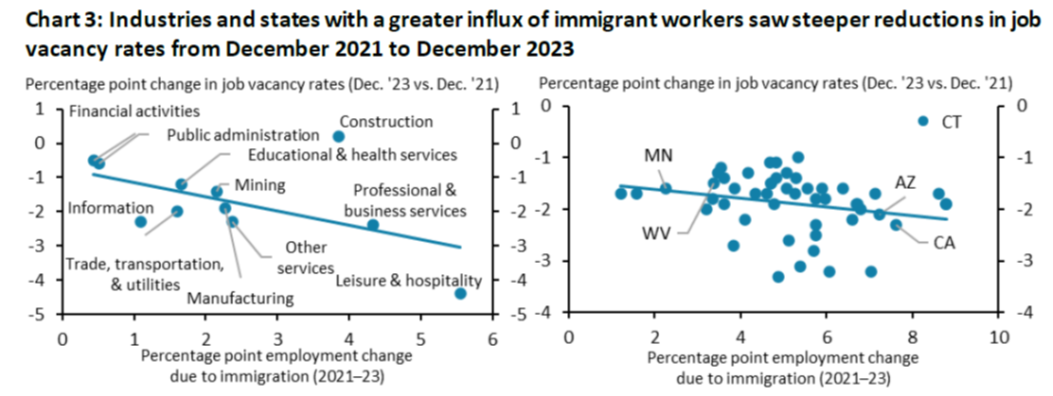

The KC Fed has simply supplied some insights into how immigration helped enhance slack within the labor market (h/t Torsten Slok).

Supply: Cohen/KC Fed (2024).

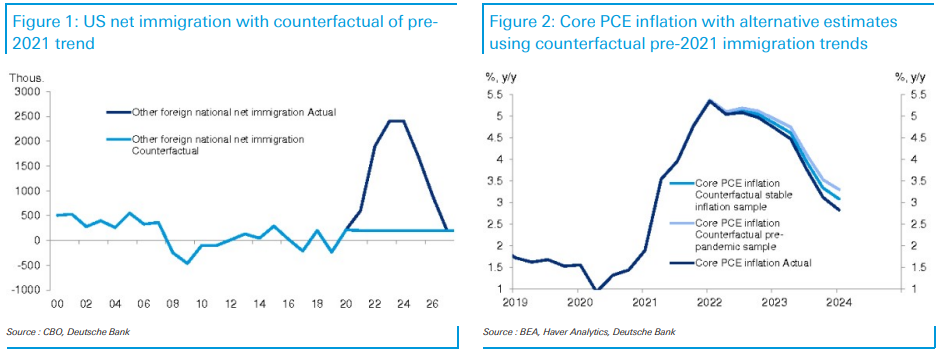

Deutsche Financial institution has taken a stab at assessing the influence of immigration on inflation by reference to a counterfactual.

Jim Reid at DB writes:

The conclusion [of Justin Weidner’s piece]: the labor market would have been considerably tighter if not for the uptick in immigration. A tighter labor market within the absence of immigration would have led to greater inflation. Utilizing two inflation fashions, our economists discover that core PCE inflation seemingly would have been 25-50bps greater (see second chart beneath), although they admit to significant uncertainty round these estimates. Immigration was clearly not the one disinflationary drive for the US financial system over the previous yr – to make sure, core PCE inflation fell 200bps in 2023 – however it was an essential contributing issue

For an earlier dialogue of labor drive dynamics and immigration, see Edelberg and Watson (March 2024), and the long run implications in CBO (2024).